Crude oil has fallen 21 percent from its recent high, causing many investors to pump the brakes on the energy sector, but as the commodity nears four-month lows, some traders apparently think the sell-off might be overdone.

"There was massive put volume in the XLE energy select [on Wednesday]," options trader Dan Nathan told CNBC's "Fast Money." "But that doesn't necessarily mean it was a bearish thing."

Nathan noted that much of the action was circulated around sellers of puts, meaning traders were actually closing bearish positions or monetizing hedges.

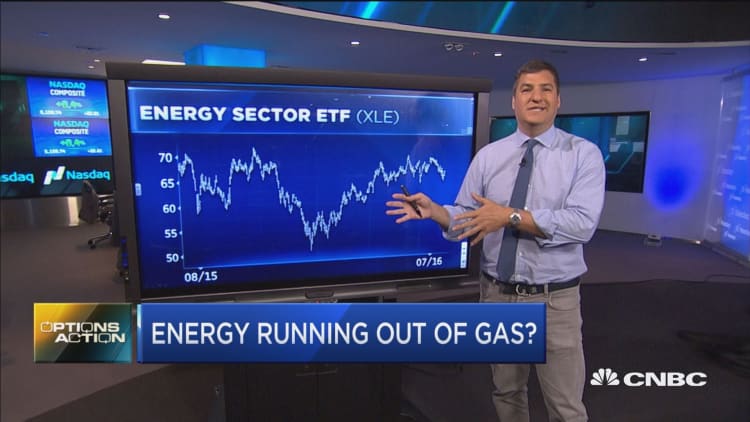

The XLE energy ETF has fallen 2 percent in the last month, as the broader S&P 500 has continued to make new highs.

Despite the negative returns, Nathan pointed to some positive trends on the chart.

"The XLE held support where it was supposed to at $65," the founder of RiskReversal.com said Wednesday.

Furthermore, looking at the relative strength of energy stocks versus the underlying commodity of crude, he said that the XLE has held up quite well.

"The commodity was down peak to trough 24 percent from early June and the commodity was only down 8 percent," he said. "This is one where maybe traders are saying the XLE has room to run here."

When examining a one-year chart of the XLE, Nathan pointed to key support at $65 and said that despite the big reversal in oil, the ETF has been able to hold up well.