J.C. Penney on Friday reported a smaller-than-expected loss, but the recovering department store's revenues fell just shy of expectations.

Penney's shares were up 1.8 percent in premarket trading, after initially turning down following the earnings announcement.

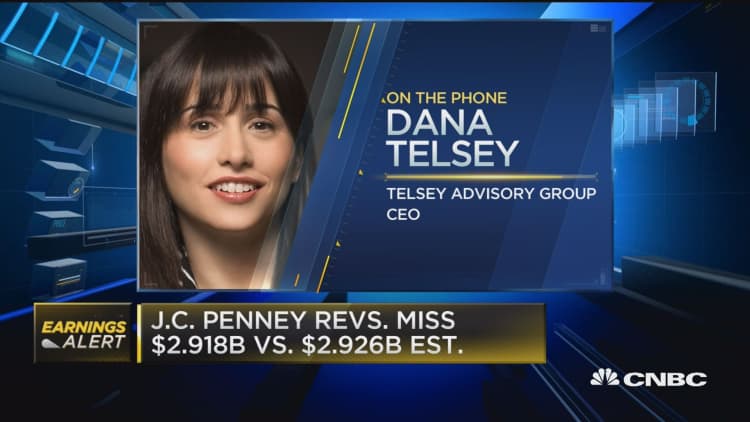

Penney posted a loss of 5 cents a share during the fiscal second quarter, on revenue of $2.92 billion. Analysts had expected a loss of 15 cents a share on $2.93 billion in revenue, according to a consensus estimate from Thomson Reuters.

The chain lost 41 cents a share in the prior-year period, and generated revenue of $2.88 billion.

Penney's comparable sales also fell just short of Wall Street predictions, rising 2.2 percent. A Thomson Reuters estimate expected the company to post a 2.4 percent gain. That metric turned slightly negative in the first quarter, following nine quarters of flat or positive results.

The company reiterated its 2016 guidance, which calls for a comparable sales gain of 3 percent to 4 percent and EBITDA of $1 billion. For the fiscal second quarter, its EBITDA was $229 million.

"We are pleased with the sequential improvement we achieved throughout the second quarter, and our solid performance across all key metrics is encouraging," CEO Marvin Ellison said.

"We are excited about the initiatives we have in place to drive incremental growth in the back half of the year."

Those initiatives include expanding its Sephora beauty business and the continued rollout of appliances. For the quarter, the Sephora business was a top performer, as were home, footwear and handbags.

The retailer, which is attempting to turn around its business after years of sales declines, said at the end of the first quarter that many of its initiatives would have a larger impact in the second quarter and beyond. The 0.4 percent drop in same-store sales it reported for that three-month period was likewise muted compared with declines seen at Macy's and other competitors.

In their quarterly earnings reports, Macy's and Kohl's beat Wall Street's profit and sales expectations, though their revenue shrank from the prior-year period.

Following dismal results from the department stores in the first quarter, these less-bad results were good enough for investors, who sent the companies' shares up double digits.

Despite gaining ground, Penney's annual revenue remains well short of the $19.9 billion it reached less than a decade ago. Last year, it brought in revenue of $12.6 billion.