In a bleak new letter to investors, Paul Singer's Elliott Management warns that the bond market is "broken" and that when the central bank actions of recent years no longer ward off a market downturn, the subsequent loss of confidence could be severe.

The fund's recent investor letter, which covers the second quarter, notes that Elliott's managers are currently seeing "what is in many ways the most peculiar period we have faced in 39 years."

Too much power has been ceded to central banks, the letter adds, the value of money has been debased, inflation is probably inevitable, and when it happens, it could be swift and impossible to tamp down.

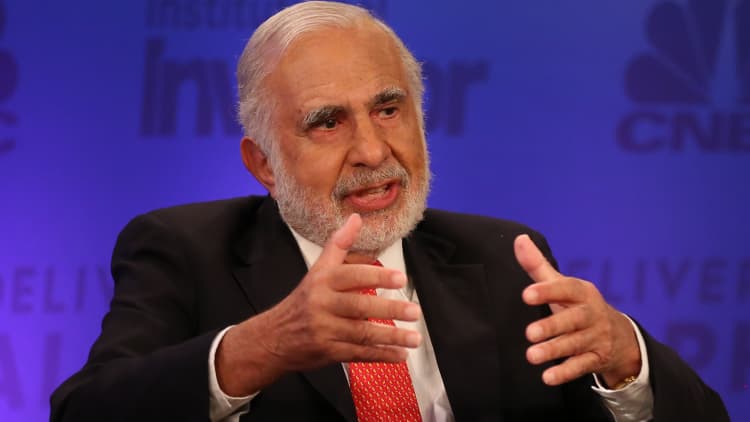

Elliott is a $28 billion fund founded in 1977 by Singer, now its president. The fund is up more than 6 percent for the year through July, according to an investor. (Singer is scheduled to deliver a keynote address at the Delivering Alpha Investor Summit, Sept. 13.)

Given the persistence of low or negative yields on government and other bonds and the continued stampede to buy them nonetheless, today's environment marks "the biggest bond bubble in world history," and "the global bond market is broken," the investor letter states.

The letter discusses, at some length, the oddity of an investor mentality that flies to an asset class regarded as a "safe haven" even when there are low or nonexistent returns attached to it and no guarantee that current conditions will persist.

In one wry aside, the letter suggests a safety warning be attached to the $12 trillion government bond market now trading at negative yields: "Hold such instruments at your own risk; danger of serious injury or death to your capital!"

Trading in this market is particularly difficult, it adds. "Everyone is in the dark," Elliott notes. "Experience doesn't count for much, and extreme confidence may be fatal." Moreover, "the ultimate breakdown (or series of breakdowns) from this environment is likely to be surprising, sudden, intense, and large."

With those dangers looming, Elliott managers reflect on the importance of hedging for possible headwinds to the company's portfolio.

Among other things, the letter adds, the hedge fund is seeing opportunity in the distressed-energy sector despite the rebound of oil and gas prices from their lows. The fund also has been building up its gold position "in a conditional format," to ebb losses "should prices fall back from their recent strength."

Elliott also takes pride in its own recent performance — Elliott Associates, its U.S.-based fund, was up 2.3 percent for the second quarter and 5.1 percent year to date through June 30, besting the as well as three-month Treasury bills. The letter makes a defense of alternative investments like it at a time when investor redemptions and underperformance are dogging many of its rivals.

"It seems to us that investments and trading strategies which make money in a value-added way, in a different manner than the returns obtainable from the passive ownership of stocks and bonds, are especially good additions to institutional portfolios in the world going forward," the letter states.

That may be a more challenging argument for the average hedge fund competitor, which according to the HFR composite is up just 3 percent through July versus an S&P 500 that's up more than 6 percent.

It's the type of underperformance, driven in part by overly crowded trades in stocks and other assets, that prompted Third Point CEO Dan Loeb to predict a coming "washout" in his industry earlier this year.