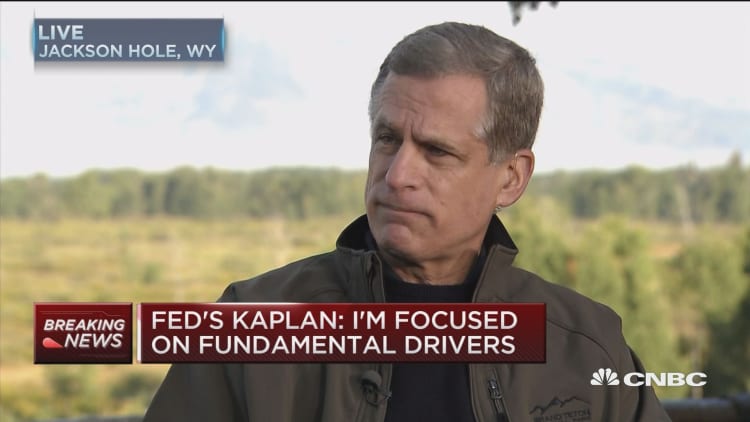

The case for increasing interest rates is building, Dallas Federal Reserve President Robert Kaplan told CNBC on Thursday, but he refused to put a timetable on a possible move.

While he's not a voting member on the central bank's policy committee in 2016, Kaplan rotates in next year.

A strong August jobs report, released by the government on Sept. 2, should not be interpreted as a sign the Fed would hike rates later in the month, Kaplan told "Squawk on the Street" from Jackson Hole, Wyoming.

That's where central bankers were meeting this week at the Kansas City Fed's annual Economic Symposium.

"One jobs report is not going to drive our thinking," Kaplan said. "[But] I do believe the case for removing accommodation is strengthening."

There have been recent rumblings from some Fed officials suggesting a September rate hike is back in play. The Fed raised rates for the first time in more than nine years in December.

As far as the health of the economy, Kaplan said: "We're making progress on the employment front. And labor slack is coming out of the labor market."

"We're [also] making frustratingly slow progress, but some progress on inflation," he continued. "I think GDP growth in the second half of the year will be strong because the consumer is strong."

Kansas City Fed President Esther George, a policy-panel voting member, told "Squawk Box," in an interview from Jackson Hole that aired earlier Thursday,that it's time to hike rates, but gradually.

George also sees second half economic growth, with the consumer leading the way.

Fed Chair Janet Yellen addresses the symposium on Friday.

Looking at the financial markets, Kaplan told CNBC: "I think right now we've got very good, healthy financial conditions that are conducive to growth."

He said markets are a factor in deciding monetary policy. "I'm always looking for threats of financial tightening or bouts of instability."

"We're in sort of a benign period here," he added.