Policymakers at the U.S. Federal Reserve have been accused of using ambiguous and evasive language after several days of commentary that has raised the possibility of an upcoming rate hike by the central bank.

"Fedspeak has bordered on Fedequivocation recently, and not just because of multiple voices. Individual officials have sent mixed signals as well," Jim O'Sullivan, chief U.S. economist at High Frequency Economics, said in a note Sunday.

His view follows the Fed's Jackson Hole symposium last week which saw Chair Janet Yellen open the door to a September hike when she said the case for a rate move had strengthened in recent months.

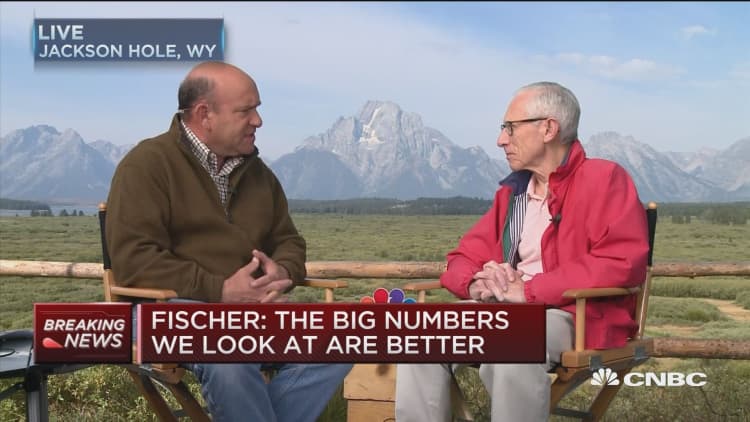

Investors initially read Yellen's speech on Friday as slightly hawkish. But, then markets quickly snapped back as traders changed their minds, seeing her words as benign with no impact on expectations that the Fed would move sooner than December. There was more to digest later in the day when, in an interview with CNBC, Fed Vice Chair Stanley Fischer put the focus on this week's August jobs report and forward data.

O'Sullivan highlights that Fed members have had a "seemingly coordinated" hawkish tone but have also been "speculating dovishly" about the longer-term implications of structural changes relating to potential growth and where the "neutral" interest rate should be. He said that Yellen "did not provide much clarity" but critiqued the comments from Fischer as well as San Francisco Federal Reserve Bank President John Williams and New York Federal Reserve President William Dudley.

David Man, a partner at investment management firm RMG Wealth Management, called Yellen's speech "far too balanced" and said she "likes to try and please everyone whilst never generating much clarity."

"This was a chance for her to either to clarify near term Fed policy (on which she was fairly non-committal), or to outline a new framework for future monetary policy, which she failed to do in our opinion," he said in a note on Sunday.

Investors will now try to second guess whether the Fed will move before the end of the year and volatility is expected to hit equity markets this September. The U.S. dollar ticked higher on Monday in anticipation and nonfarm payrolls this Friday will be seen as crucial. The market has now priced in a 33 percent chance of a hike in September, up from 18 percent before Yellen and her deputy Stanley Fischer spoke on Friday, according to CME Group's FedWatch tool.

O'Sullivan said that Fed officials have sounded close to tightening on several occasions in the past year and a half, only to back away because of weaker-than-expected data or some turmoil in financial markets. O'Sullivan and High Frequency Economics now expect tightening to be delayed until December.

"Tightening as soon as September 21 remains possible, but it would probably require stronger-than-expected data in the next couple of weeks. We don't see much chance of a move at the November 1-2 meeting; Fed officials will likely want to keep a low profile in the week before the presidential election," O'Sullivan said.

—CNBC's Patti Domm contributed to this article.