After years of strong performance Salesforce.com CEO Marc Benioff has earned the right to be taken at face value, Jim Cramer says.

Shares of Salesforce fell more than 4 percent on Thursday after it reported what Wall Street viewed as disappointing guidance for its third quarter.

"When a person with an exemplary record of beating the highest of expectations slips up and tells it like it is, blaming his team and, more important, himself for the miss, you give him the benefit of the doubt," the "Mad Money" host said.

Because the stock sports a high price-to-earnings multiple and guided down, Cramer understood why investors would want to sell.

On the surface, Cramer found Salesforce's quarter good. It did report better-than-expected revenue and earnings, and it raised its full-year revenue forecast.

However, it left no doubt to Cramer that next quarter miss expectations, with revenues projected to come in at $2.11 to $2.12 billion, versus the $2.13 billion investors expected.

Marc's whole way of being is to NOT blame the economy. I felt relieved at that. He talked about being disappointed in his own company's execution.Jim Cramer

What caused Salesforce to lower projections?

Cramer boiled it down to what he referred to as a "face value" analysis. First, Salesforce made several acquisitions this quarter. Acquisitions tend to distract at first, but often executives must take that risk for a smart purchase.

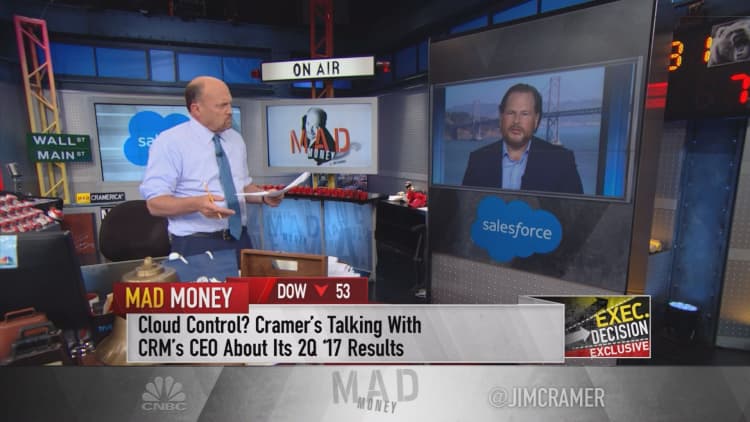

Second, in an interview with Cramer on Wednesday, Benioff stated that the foreign exchange currency hit was "brutal," with an expected $150 million loss in revenue as a result. Cramer was surprised to learn that Salesforce rolls its European revenue through the U.K., thus the sharp decline in the British pound affected it.

Third, Benioff cited softness in the U.S. at the end of the quarter.

"Wow. Softness. When I heard it, I went ashen," Cramer said.

Not only had Cramer never heard Salesforce mention the backdrop of the U.S. before, but he was surprised to hear softness happened in the U.S. Cramer views the U.S. as one of the strongest markets in the world for technology right now.

When pushed further, Benioff made it clear to Cramer that the ultimate disappointment in July was Salesforce, not the economy.

"That is important. Because Marc's whole way of being is to NOT blame the economy. I felt relieved at that. He talked about being disappointed in his own company's execution," Cramer said.

In other words, Cramer said, Salesforce did not close on the business it wanted to, and that is why the stock fell on Thursday.

Yet, Cramer doubts that investors will believe the issues were internal. He expects them to think that the space has become too competitive, and Salesforce lost business to others.

Additionally, Cramer also noted that some "fair weather friends" could conclude that Salesforce has become too big. Benioff visited Japan for a bit before taking personal time in Hawaii, as he always does.

"Believe me when I say he is always working, no matter where he is. But I'm sure there will be some who say that without Benioff riding herd every minute these days, the company couldn't make the numbers and that is because the space has gotten so crowded that there is no room for leisure. I think it's a harsh judgment," Cramer said.

As for merger activity, companies are often applauded for doing deals when they are riding high, he said. And when a company is not firing on all cylinders, it can be seen as masking a slowdown.

Going forward, Cramer anticipated that investors will hear about several soon-to-be-closed deals and new business in the next quarter. And Cramer is willing to take Benioff at face value.

"You go against the probabilities and hold the stock. If it goes lower, you buy it," Cramer said.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com