Oil prices fell as much as 3 percent on Tuesday after a series of gloomy predictions on demand growth that suggested the global overhang of unused inventories may persist for longer than anticipated.

The International Energy Agency, which advises oil-consuming countries on their energy policies, said a sharp slowdown in oil demand growth, coupled with ballooning inventories and rising supply, means the market will be oversupplied at least through the first half of 2017.

This contrasts with the agency's last forecast a month ago for supply and demand to be broadly in balance over the rest of this year and for inventories to fall swiftly.

The IEA's comments follow a surprisingly bearish outlook from the Organization of the Petroleum Exporting Countries on Monday that also pointed to a larger surplus next year due to new fields in non-member countries and as U.S. shale drillers prove more resilient than expected to cheap crude.

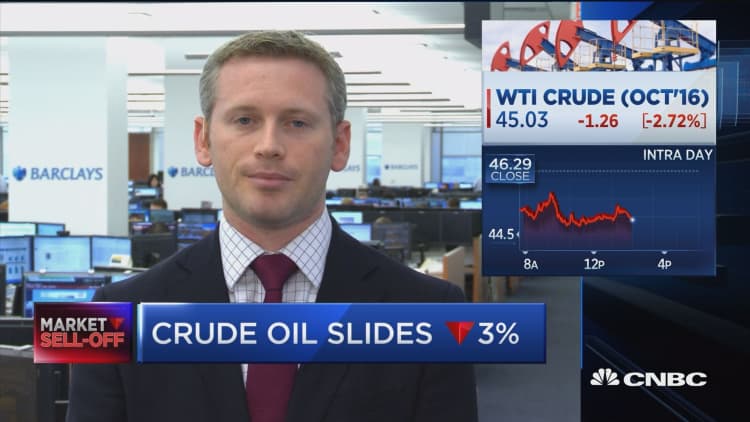

Brent crude futures were trading down $1.26, or 2.61 percent, at $47.06 per barrel at 2:49 p.m.

U.S. West Texas Intermediate futures fell $1.39, or 3 percent, to $44.90 a barrel.

"It seems the situation has deteriorated strongly in the eyes of OPEC as well as the IEA," Commerzbank head of commodities strategy Eugen Weinberg said.

"I wouldn't be surprised to see this price weakness continue for a while right now, because that was not on the cards, in our opinion."

A stronger dollar also weighed on crude and other commodities denominated in the greenback, making them less affordable to holders of currencies such as the euro. U.S. equity markets fell more than 1 percent, adding to the bearish sentiment.

Upbeat Chinese data on industrial output growth for August failed to lift oil prices as the crude market remained in a profit-taking mode, traders said. China's industrial output grew the fastest in five months as demand for products from coal to cars rebounded thanks to higher government spending and a year-long credit and property boom.

Speculators in U.S. and Brent crude futures took an axe to their long positions in the latest week, cutting the combined net speculative length in the two contracts by 80 million barrels, according to PVM Oil Associates.

Analysts expect U.S. government data on Wednesday to show a stockpile build of 4.5 million barrels in crude last week. The American Petroleum Institute, a trade group, will release its own preliminary supply-demand report for last week at 4:30 p.m. (2030 GMT) on Tuesday.

Oil prices rose in the previous session after uncertainty over a potential U.S. Federal Reserve rate hike in September weighed on the dollar.

Even so, expectations of U.S. monetary tightening before the end of the year, along with the bleak demand outlook projected by the IEA, further diminished market optimism that the world's largest oil producers might agree to freeze output when they meet for talks in Algeria on Sept. 26-28.

"The idea of an oil production freeze makes even less sense if demand falls apart while U.S. monetary stimulus is being removed at the same time," said David Thompson, executive vice-president at Powerhouse, a commodities-focused brokerage in Washington.