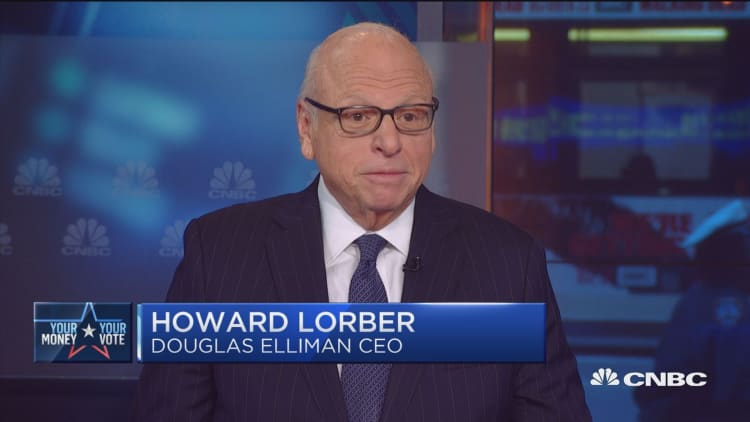

Donald Trump's comeback in the 1990s was not due to tax maneuvering but from shrewd business acumen, said Trump supporter Howard Lorber, chairman of New York City real estate powerhouse Douglas Elliman.

The GOP presidential nominee's use of the net operating loss provision to the tune of $916 million in 1995 — and speculation he may have paid no income tax for nearly two decades — has created a tug-of-war, with supporters calling the move smart and critics crying foul.

Trump's campaign narrative that he's a smart businessman and successful dealmaker, therefore he'd make a good president, still rings true, Lorber told CNBC's "Squawk Box" on Wednesday.

"The comeback came pretty quickly. And the chances are he didn't have the chance to even use that loss carry forward [tax move]," the Douglas Elliman chairman said, adding he's "bullish" on Trump winning the presidency.

According to The New York Times, Trump faced hard times coming out of the 1980s.

By 1990, Mr. Trump had amassed $3.4 billion in debt, much of it in the form of high-interest junk bonds. He was personally liable for $832.5 million of that.

Lorber, who has known Trump for three decades, countered by saying: "His comeback was because he stuck it out, he worked out things with the bank, he's a good negotiator, and he lived another day to start again."