If investors are looking for the next U.S. president to create stability in the markets, it's not going to happen—says former U.S. Representative Ron Paul.

Along with jitters about the Federal Reserve's next move on interest rates, investors are weighing whether Democratic contender Hillary Clinton or Republican nominee Donald Trump will be better for investors. The libertarian icon and former Texas Congressman suggested market players may not want to hold their breath.

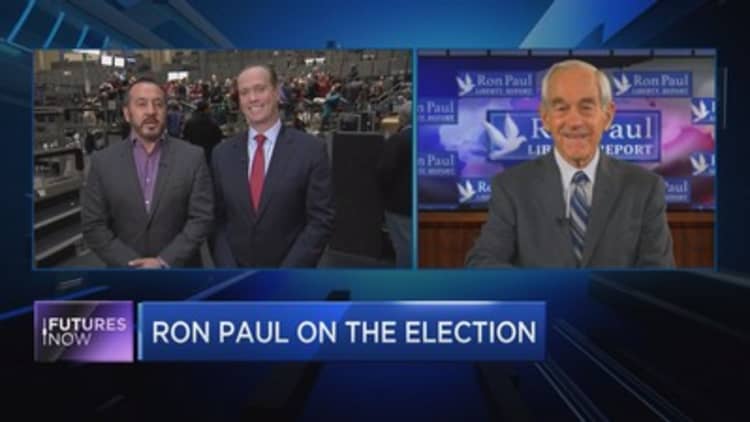

"Politically speaking, there is going to be a lot more uncertainty and that may go into the markets," Paul told CNBC's "Futures Now" in a recent interview. "If people are depending on political stability to get the market going I don't think it's going to work out."

Clinton will face off against rival Trump on Sunday in the a town-hall style debate. Many are calling it a make-or-break night for the candidates, but for Paul it will simply be a non-event.

"I think [the election] is up for grabs. It will depend on how many people stay at home," he explained. "People are so disgusted with the two candidates that it's pretty hard to predict" which will prevail, he said.

For Paul, it doesn't matter what the outcome is in November, as he doesn't see much of a difference between the two parties.

"Nothing ever really changes regardless of which party wins. Governments keep growing, the deficits keep growing and the Fed keeps borrowing and printing more money," he said. "I don't expect a lot to change."

No to the candidates, yes to bullion

But there is one area of the market that the former Libertarian and Republican presidential candidate sees flourishing in the long-term: , which ended Friday near $1,259.

The precious metal just posted its worst weekly drop since 2013 as the markets weighed an interest rate hike later this year. A note from Wells Fargo Investment Institute warned last week that bullion could easily shed another $200 per ounce before finding support.

Yet according to Paul, that shouldn't deter investors from hunkering down on the commodity.

"If the economy is truly getting better, that would be better for gold long-term," said Paul. "Short-term gold has taken a big hit and it could very well go down more, but it's still up 10 percent from a year ago."

Paul noted that gold has returned 300 percent since the year 2,000 while the Nasdaq has rallied just 6 percent.

"The laws of economics are more powerful than all the politicians and all the bankers. It's just that it's erratic and very up and down and takes a while to stort out," Paul added. "Believe me, gold prices are going up."