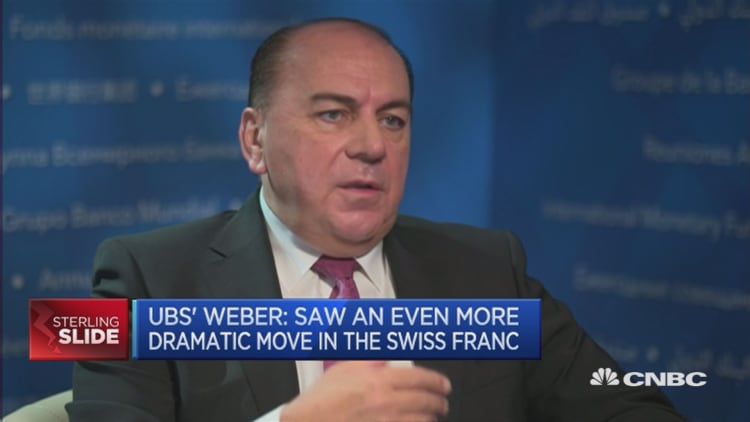

The investment community is currently facing a time of low volumes and major volatility that has the potential to wipe out yearly returns in a single day, according to UBS Chairman Axel Weber.

"Markets have to get used to that," he told CNBC on the sidelines of the annual meetings of the International Monetary Fund and the World Bank.

"You can nowadays see the entire return that you expect for a year being wiped out for a single day move in the market. And that is an unprecedented situation."

Weber added that there were current poor returns for investors due to the low interest rates employed by global central banks. He said that investors were being forced to venture into "mature country risk" such as the surprise result of the Brexit referendum in the U.K.

He explained there was "almost no beta in the market," which is an investment strategy that closely tracks highly volatile stocks that offer decent returns. He also added that there was massive volatility in the market with the new "re-regulation" since the global financial crash of 2008.

"Most of the larger banks have stepped out of market making. And part of the regulation - basically don't hold proprietary positions - if you don't hold proprietary positions you are not that interested in market making," Weber added.

"We have not really replaced the banks stepping out of market making by other players joining."