Time Warner stock was flat Wednesday after the media and entertainment conglomerate reported quarterly earnings and revenue that beat analysts' expectations.

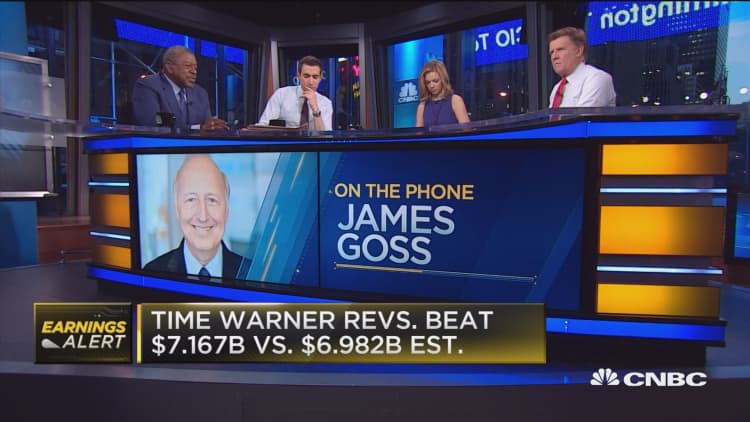

Less than two weeks after the announcement of a merger with AT&T, the company reported third-quarter earnings of $1.83 per share on revenue of $7.2 billion.

Analysts had expected earnings of $1.37 per share on revenue of $6.98 billion, according to Thomson Reuters consensus estimates.

Shares of Time Warner were unchanged in early trading Wednesday. Shares had climbed as much as 2 percent in premarket trading. (Click here for the latest price.)

"We had a strong third quarter, which keeps us on track to exceed our original 2016 outlook and underscores our leadership in creating and distributing the very best content," Chairman and CEO Jeff Bewkes said in the earnings release.

The Time Warner chief cited Primetime Emmy Awards for its HBO network, success in CNN's election coverage, milestones for its cable networks, and a strong quarter for films led by "Suicide Squad."

Time Warner said its adjusted operating income grew 12 percent to $2.1 billion from increases at all its "operating divisions and lower intercompany eliminations." Free cash flow totaled $3.3 billion, up 15 percent this year.

Last month, AT&T announced an $85.4 billion deal to buy Time Warner, one of the largest proposed media mergers in years. The decision — unanimously approved by both boards — would give the telecom giant control over cable TV channels such as CNN, HBO and TNT, film studio Warner Bros, and other media assets.

"The agreement we announced on October 22 to be acquired by AT&T represents a great outcome for our shareholders and an excellent opportunity to drive long-term value well into the future," Bewkes said. "Combining with AT&T is the natural next step in the evolution of our business and allows us to significantly accelerate our most important strategies."

After the deal was announced, AT&T Chairman and CEO called it a "perfect match" and said both companies assets could bring a "fresh approach to how the media and communications industry works for customers, content creators, distributors and advertisers."

Bewkes said he would stay at the company for one or two years if all goes according to plan.

The deal is expected to face challenges from regulators and has already received scrutiny from politicians. Sen. Bernie Sanders has asked the Justice Department to block the deal, saying in part the merger could be a "gross concentration of power" in the news media. GOP presidential nominee Donald Trump said he opposed the deal and, should he win the White House, his administration would not approve it. Democratic presidential nominee Hillary Clinton said the proposed merger should be "closely scrutinized" by regulators.

Stephenson told CNBC, however, that the megadeal is "pure vertical integration," and the two companies do not compete anywhere. Bewkes said in the same interview that consumers will end up with more choices because of the deal.

—CNBC's Everett Rosenfeld, Javier David and JeeYeon Park contributed to this report.