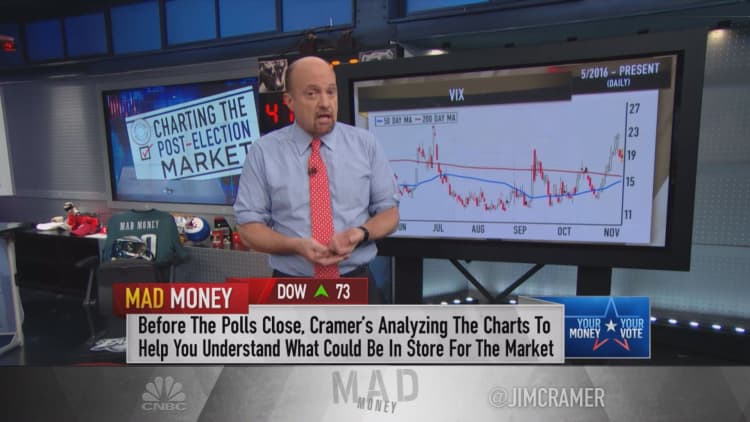

With the stock market driven by politics lately, Jim Cramer wants to get a sense of how it will behave after the election, regardless of who wins.

That is why he turned to Bob Lang, the founder of ExplosiveOptions.net, technician and colleague of Cramer at RealMoney.com, to find out what the charts predict the market will be like when a new President is elected.

Based on historical post-election patterns, Lang believes that the market is likely to improve until the end of the year. But Cramer warned that a post-election rally may not have the staying power to make it through the end of the year.

"Don't be complacent, because the big boys don't like this market for a host of reasons, not just the election, and while they might come back from the sidelines after today, the rest of the indicators say beware of any November rally," the "Mad Money" host said.

Unfortunately, this market has a real case of halitosis.Jim Cramer

When Lang took a closer look at the charts, he found that big institutional money managers have been pulling money out of the market for weeks. He thinks that it could mean that the selling was caused by something other than election fears, like the price of oil or the Federal Reserve.

The charts for the had a mixed picture, too. On one hand, the S&P tested its floor of support on Friday, and then snapped back sharply on Monday. But there was a problem with the volume, Cramer said. The volume was higher when the S&P was declining and lower when it rallied, which suggested to Lang that big institutions are eager to unload their positions.

The most troubling chart for Lang was the daily chart for West Texas intermediate crude. Crude recently tested its floor of support at the 200-moving day average for the first time since July, and given the large buildup of oil inventories, he wouldn't be surprised to see oil head down to its August low of $39.

So, while the market will have one less thing to worry about once the election is over, Cramer warned investors against getting too comfortable in a post-election honeymoon. The rally may not have staying power to last, he said.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com