Markets are focused on the Trump trade — and that means big spending and higher inflation.

After steep losses that left stock futures limit down overnight, the Dow and were sharply higher on unusually high volume, after minor opening losses. The Dow jumped more than 250 points and was racing toward a new all-time high, a radical turnaround from its 800-point loss in the futures market. The Nasdaq was higher and small caps gained, with the Russell 2000 up 2.5 percent in afternoon trading.

Treasury yields shot higher, and stocks that would benefit from infrastructure programs surged. The Dow was helped by a 7 percent jump in Caterpillar, and gains in financials — Goldman Sachs and JPMorgan Chase.

Stocks focused on the positives of Donald Trump's policies but ignored its fears that he could ignite a global trade war. The dollar jumped, and the Mexican peso continued under pressure, losing another 8 percent to record lows.

"For the first time, we have the possibility of fiscal policy being implemented in such a way that it has the possibility of changing the deflation we've had for quite a while," said Krishna Memani, CIO of OppenheimerFunds. He said near-term impacts on the economy from any potential market turbulence will likely be mitigated by a more accommodative Fed.

Trump has also proposed a lower corporate tax rate and a one-time tax holiday that would mean U.S. companies could bring back the billions they have stashed overseas.

Why banks are moving higher

Banks benefit from higher inflation — and higher interest rates – and the bond market Wednesday was in a steep sell-off, which sent yields higher. The 10-year Treasury yield rose above 2 percent, its highest level since January.The short end — the — was also higher at 0.90 percent, and that is the most sensitive to Fed interest rate hikes.

The stock market had been set up for a victory by Democrat Hillary Clinton and was expected to sell off sharply in the event of a Trump upset, because of his unpredictability and some of his policies, such as trade and immigration.

But in his victory speech in the early hours of Wednesday, he emphasized spending on rebuilding American infrastructure. That type of big spending means more debt, and has the potential to fuel inflation. The bond market was reflecting that Wednesday.

"Frankly, you don't know what he's going to do. He's an unpredictable character, and politicians say a lot of things in elections that never come to fruition. The tone of his campaign initially was very negative with his focus on immigration and trade, and became more positive with the focus on infrastructure and tax cuts," said Ward McCarthy, chief financial economist at Jefferies. "Trump is coming in defining his legacy. He literally wants to build it."

Trump also wants to boost defense spending, and stocks like Raytheon, Lockheed Martin and General Dynamics all surged more than 4 percent.

"When you look at Trump's fiscal package — he's Reagan plus infrastructure spending. He's basically faster growth, bigger budget deficits and this probably will give us inflation," said McCarthy. President Ronald Reagan boosted U.S. military spending dramatically before the end of the Cold War.

Because of inflation expectations getting higher, it's really more about buying cyclicals, buying commodities-oriented things, buying short-duration assets, value rather than growth, U.S. rather than emerging markets, small cap versus large cap, and loans versus high yield bonds.Krishna MemaniCIO of OppenheimerFunds

Memani said Trump could still be very negative for globalization and trade, but the infrastructure program changes the outlook for the U.S. economy and could break it out of a slow growth environment with no inflation.

"What it does is emerging markets, which were hot and getting all those flows, have to stop. This is anti-globalizaton and there's no way to put lipstick on that pig," he said.

Mexican stocks were down 2 percent Wednesday, and other Latin American markets were also lower. German and French shares rallied and ended sharply higher, while Asian stocks ended lower, with the Nikkei down 5.4 percent.

Trump's plan for a big spending package is critical, even with the debt, he said. "We need to do that because if we don't add to the debt there's no shot of reducing the debt over the long term," he said.

He said that makes for new opportunities in stocks. "Because of inflation expectations getting higher, it's really more about buying cyclicals, buying commodities-oriented things, buying short-duration assets, value rather than growth, U.S. rather than emerging markets, small cap versus large cap, and loans versus high-yield bonds," said Memani.

The "Trump trade" also extended to biotechs, with the IBB ETF jumping 6 percent. Clinton had vowed to go after drug pricing and was a negative for the sector. A proposition in California to regulate drug pricing also failed in Tuesday's election.

Trump will not be as combative now that he has won. The jury is out on whether he can bring back those lost jobs from overseas and restart those closed American factories. His victory is not quite like Reagan's "Morning in America, Prouder, Stronger, Better," but maybe the votes for change will eventually be seen in a more positive light. Right now though the East Coast and West Coast of the country is in shock.Chris Rupkeychief financial economist at MUFG Union Bank

Analysts have debated whether a Trump sell-off would be followed by a sustainable bounce back that could carry markets higher into year-end. Some believe that it will, but Morgan Stanley strategists said in a note Wednesday that they would not buy the dip and they are more bearish than before the election because of the uncertainty.

However, they offered some stock picks that they see doing well in the new administration and would add to industrial holdings.

"We think there will be some excitement in the coming weeks about some additional infrastructure spending, an area where there appears to be some political common ground. Many of the key end markets have stopped deteriorating and are now showing second-derivative, if not first-derivative improvement, including the oil market, metals and mining, and select infrastructure," they wrote. "We are positive on more housing structures and household formations." They also like defense and airlines.

Chris Rupkey, chief financial economist at MUFG Union Bank, said he still sees a rate hike in December, and he agreed with others on the sectors that will benefit from a Trump presidency.

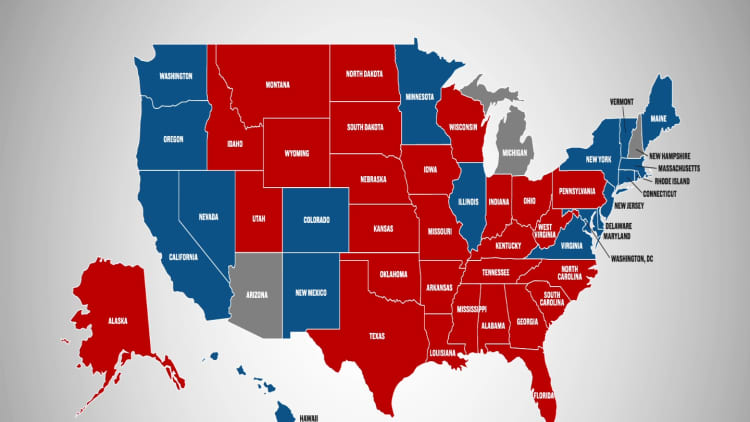

"Health care and financial company stocks will lead the way," Rupkey wrote. "Trump will not be as combative now that he has won. The jury is out on whether he can bring back those lost jobs from overseas and restart those closed American factories. His victory is not quite like Reagan's "Morning in America, Prouder, Stronger, Better," but maybe the votes for change will eventually be seen in a more positive light. Right now though the East Coast and West Coast of the country is in shock."