Next week's OPEC meeting could send oil back to $50, but investors may want to curb their enthusiasm.

In a note from RBC Capital Markets on Tuesday, head of commodity strategy Helima Croft wrote that OPEC would "stick the landing" at its Nov. 30 meeting and finally draw a long-awaited agreement. The main player will be the world's largest oil producer, Saudi Arabia, as Croft believes that the Saudis now have incentive to agree to production cuts.

"I think the burden is going to be heavier on Saudi Arabia [because they have] key policy priorities, they want the IPO of Saudi Aramco," Croft said Tuesday on CNBC's "Futures Now."

Saudi officials have been pushing for a 2018 IPO listing for Saudi Aramco, the world's biggest oil company. Croft believes the Saudis need oil to return to $50 to stay on track for the listing. She said Saudi officials have already began talks to cut production by 1.1 million barrels to boost crude prices.

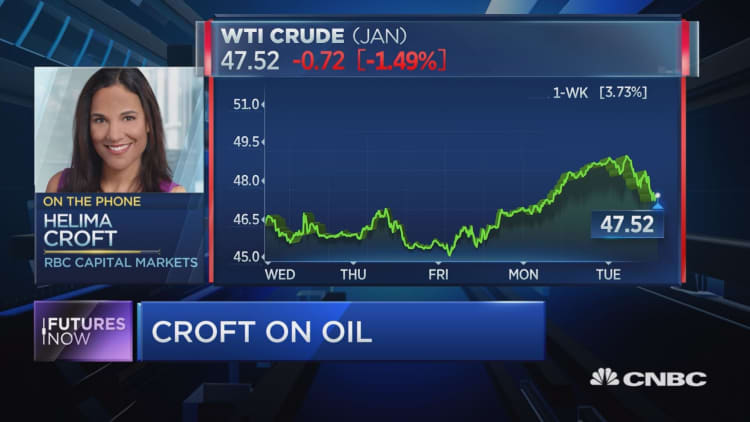

U.S. benchmark West Texas Intermediate crude was at $47.65 a barrel on Wednesday morning. But while oil may just return to $50, which is seen as an important technical level for investors, Croft thinks that Saudi concerns about the U.S. will clip the wings for any higher rally.

"Why I don't think they're aiming for $60, $70, or even $80 right now is they want a muted recovery," said Croft. The Saudis "keep talking about $50 oil because I think they are concerned that if this rises too fast, you'll get U.S. production roaring back."

Crude has climbed almost 5 percent in the past week, but the rally came as production in the U.S. jumped. While oil surged more than 4 percent on Monday, the commodity slightly reversed its gains on Tuesday over supply concerns and worries that OPEC still won't strike an agreement to limit production.

Nevertheless, Croft believes the oil cartel will find some middle ground next Wednesday. With Saudi Arabia taking the "lion's share" of production cuts, other oil producers like Iran and Iraq could also be pressured to follow suit.

Crude is currently up almost 30 percent year to date, though the commodity has struggled to break too much beyond $50 this year.