Investing in a world where Donald Trump is running the largest economy is likely to be a considerably different experience than it was in the eight years before he came to power.

Pre-Trump, the major themes were low interest rates, falling yields and low inflation levels. Now, investing ideas already have shifted even before Trump assumes the presidency in January.

The market is focusing on higher levels of inflation and rising yields, and it's tiptoeing into an unsure era where the Federal Reserve unwinds the extraordinary amount of accommodation it's provided over the past eight years.

"The next few quarters are setting up as a cyclical investor's dream, but like all dreams, they require some interpretation," Nick Colas, chief market strategist at Convergex, said in his daily note to clients Tuesday. "The funny thing about cyclical stocks" — shares, such as those in consumer discretionary companies, whose price is affected by the overall economy — "is that investors give them far more leeway than other sectors during an expected upswing."

Indeed, it pays to take a closer look at what is happening in the market when trying to divine what has generated the Trump rally. In this case, it's better to turn the old adage on its head and look at the trees rather than the forest.

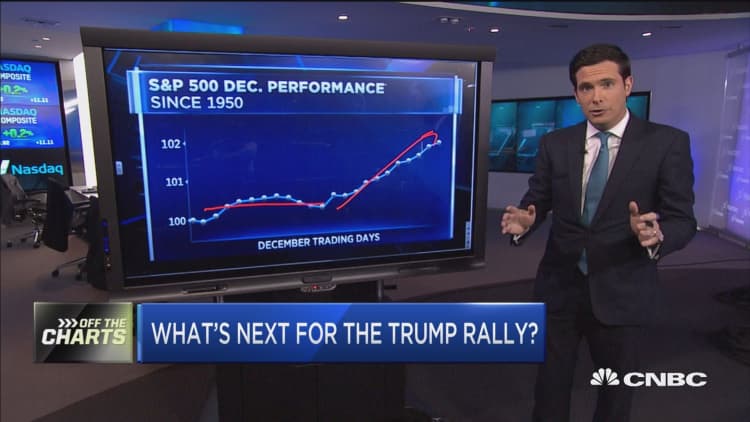

The three weeks since the election have featured a fairly uneven rally, with financials dominating and more than half the sectors lagging the 's 3.2 percent gain.

Colas thinks the days ahead will generate more changes as investors gear up for the new environment. Traditional parameters that indicate the S&P 500 is overbought trading at 17 times earnings will have to be re-examined.

"The truth is more nuanced, for in reality the whole framework of market expectations has shifted, and rapidly at that," he said. "Investors will have to adapt to a world where the companies they own do some investing as well, rather than hand back all their earnings in buybacks and dividends. And sectors like financials and industrials, long forgotten, may once again show a cyclical resilience out of pace with their near-term fundamentals."

Jim Paulsen, chief investment strategist at Wells Capital Management, worries that investor expectations in the post-election euphoria have gotten elevated. Market behavior seems to back up the concern.

The most recent American Association of Individual Investors survey saw bullishness — expectations that the market will be higher in six months — at 46.7 percent, the highest since February 2015. The pessimism level fell to 26.6 percent, its lowest since mid-August.

Investor money has been pouring into equities, with stock-based exchange-traded funds pulling in $41.5 billion just over the past month. The Financial Select Sector ETF, which tracks banks and other financials, has seen a 37 percent gain in investor cash during the same period, bringing the fund's total assets under management to $20.7 billion, according to FactSet.

"I'm really still suspect that the Trump train is going to be near as fast or dramatic as the market seems to suggest," Paulsen said. "I get the idea after spending this entire recovery with a culture that's been worried about the deflationary abyss ... for a while it could create more of a confidence boost than a negative force."

Market participants are betting that the president-elect's aggressive fiscal policies, backed up by a Republican Congress, will boost an economy that has struggled to grow more than 2 percent a year.

"The problem with that scenario is while it could be a pretty good tonic for a short period of time, maybe even a few years, it could end badly," Paulsen said.

He recommends investors pivot from what had worked in the past to what should work going forward.

"We're changing, there's no doubt about that. What drove this bull up until about a year ago was disinflation, falling yields, chronic Fed accommodation," he said. "Now we have a trend that is re-inflationary, upward-trending yields, and policy officials moving to the sidelines."

He recommends emphasizing global companies, industrials, materials and financials, as well as shifting from large-cap companies to small- and mid-cap.