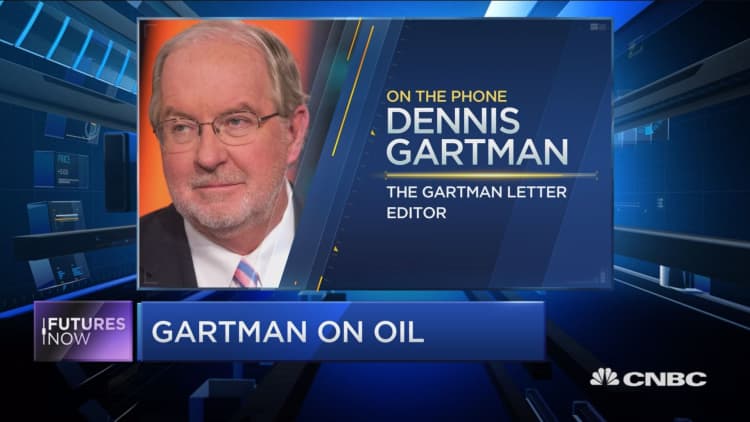

The surprise OPEC deal last week sent crude prices surging and left some market watchers slack-jawed, including Dennis Gartman.

The agreement came after months of false starts, including a failed accord in Doha, Qatar, in April that sent markets reeling.

"Clearly we were wrong in selling crude oil short the day before the OPEC meeting," the editor and publisher of The Gartman Letter wrote Thursday. Despite being caught off guard by the move, Gartman explained to CNBC why he doesn't expect the rally, or deal, to last long.

"If you can bet on one thing in this world, bet on a mother's love, and bet on the fact that OPEC cheats," he said in a recent interview on CNBC's "Futures Now." "But it will be a month or two before we see that happening."

Oil surged above $50 for the first time since late October in the days after OPEC's agreement to cut production for the first time in nearly a decade. The move prompted crude to post its biggest weekly gain since February 2011.

Still, Gartman is skeptical that the rally can be sustained, as he believes the recent run has been nothing more than a short squeeze. Meanwhile, tensions between OPEC rivals Saudi Arabia and Iran — which was resistant to the idea of a curb on production — mean something may have to give eventually.

"I've said for a long time that i don't expect oil to get above $52," he said. "There are so many people caught on the short side of WTI and that's what you are seeing right now. That will end sometime in the coming weeks," said Gartman.

In addition to what he anticipates as a failed agreement, Gartman said the strong will weigh heavily on oil and all commodities in the next year.

"The strong dollar is going to continue to be overhead resistance on commodity prices. Clearly that adds to the price of crude oil and that is bearish in the long run," he said.