Jim Cramer was stunned by the lack of homework done by investors on Friday, and he hopes that doesn't extend into next week.

Shares of Honeywell dropped sharply after the company indicated that earnings could come in at the low end of its range. Investors forgot that industrials don't trade on earnings, but on organic growth. When taking that into consideration, the company actually guided up on that key metric.

"Just because we have a good run, that doesn't mean we stop doing homework. Don't be a misinformed miscreant. I'm begging you, take a few moments to do some thinking before you take action," the "Mad Money" host said.

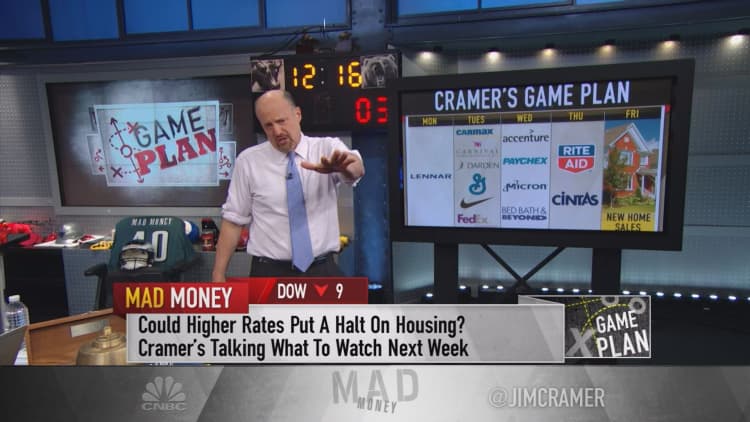

With this in mind, Cramer outlined the game plan of stocks and events on his radar next week:

Monday: Lennar

Homebuilder Lennar is down more than 11 percent for the year. After a weak housing starts number on Friday, Cramer is concerned about housing because of the sudden jump in interest rates. He expects to hear a case from the CEO on how the stock will be a winner under the Trump administration, so he's willing to keep an open mind.

Tuesday: General Mills, Nike, FedEx

General Mills: This stock tends to go down after any kind of a report, but then turns into a "buy," especially if the yield goes up.

Nike: With three notes released on Friday expecting a shortfall from Nike when it reports, Cramer wondered if instead there could be a boomerang, like with Lululemon.

"I suggest you wait until Nike reports and then if it is weak, Foot Locker will likely go down, and I'd buy the stock of that retailer … if Nike misses, that could be good for Foot Locker as long as the shortfall was caused by price competition," Cramer said.

FedEx: This one could be big, Cramer said, and the "pin action" could extend to both UPS and Amazon.

Wednesday: Accenture, Paychex, Micron, Bed Bath & Beyond

Accenture: This stock has run hard since its last report. So, no matter what the quarter is, Cramer expects profit taking. If that is the case, he said to buy Accenture the same night, especially if it continues to decline.

Paychex: With the Federal Reserve poised to raise interest rates again, Paychex could make more money. Cramer said to buy it ahead of the quarter, especially if small business hiring is on the verge of acceleration.

Thursday: Cintas

This famous super-Trump stock recently merged with its competitor G&K Services. Cramer's ready to hear a good story about job growth and synergies between the two.

Friday: New home sales

Cramer plans to use the read from Lennar's earnings on Monday as a window in to what the new home sales could look like. He wants to see that higher rates haven't derailed the sector, though he believes housing is still on track.

"It's holiday time, which has often produced very good performance. I wouldn't be surprised if it does so again," Cramer said.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com