The Dow Jones Industrial Average has been struggling this week to get over 20,000. The index crossed 19,900 on Tuesday.

But this could be one of those self-fulfilling prophecies: If markets don't get above 20,000 right away, it might struggle for awhile to get there.

Let's consider a few examples:

(1) When the Dow crossed 4,900 in 1995, there was no stopping it. Three days, later it hit 5,000 intraday, and a day after that it closed above 5,000.

(2) Or consider the move to 15,000 just three years ago. The market blew right by 14,900, crossing that and hitting 15,000 in the same day. Just two days later it closed above 15,000.

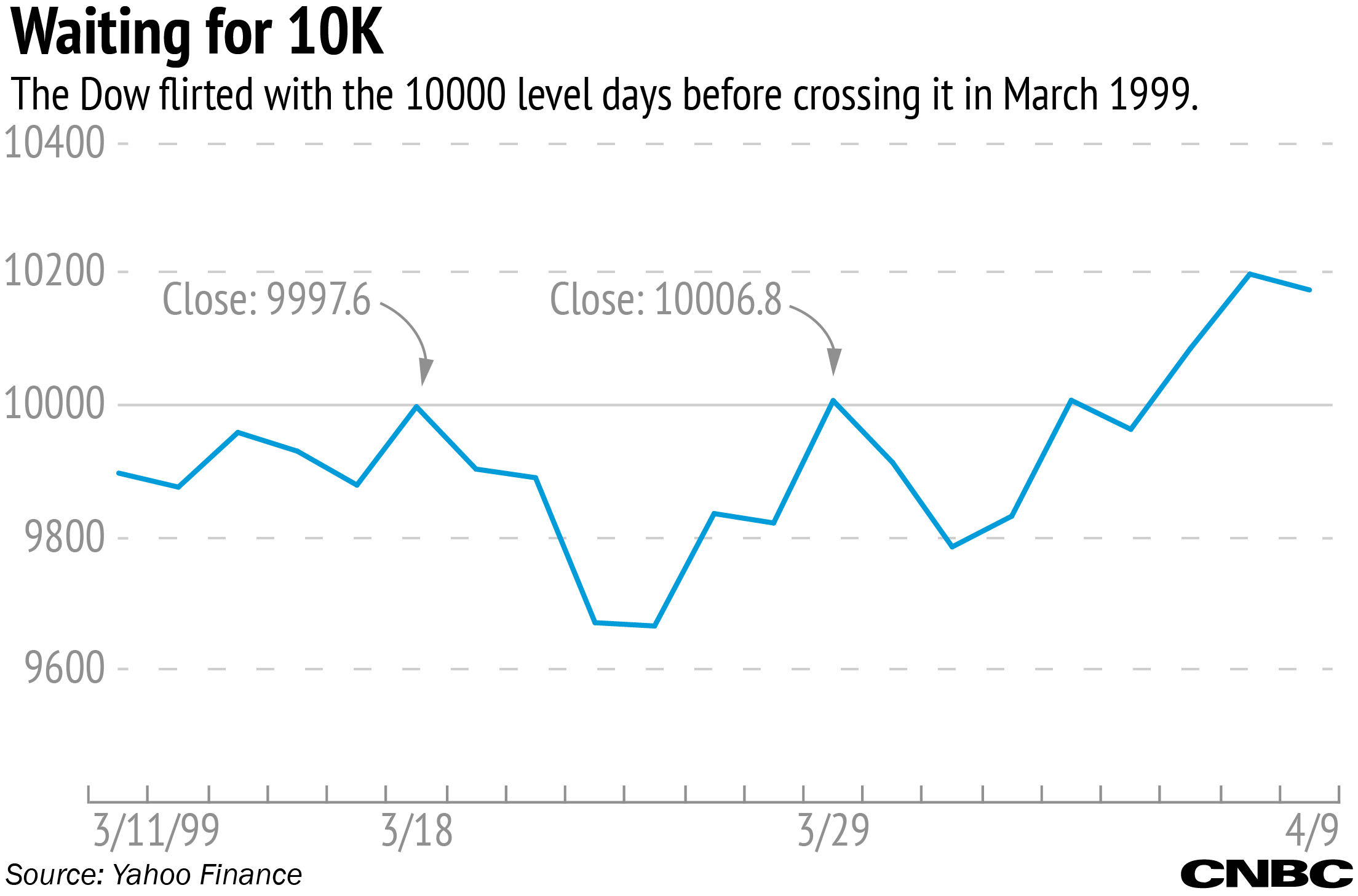

(3) The situation now might be closer to what happened at the 10,000 level back in 1999. The index hit 9,900 and then had to wait three trading days before touching 10,000. But then it took nine more trading days, or 12 in total, to close above 10,000. That included a close of 9997.6 and a drop all the way to 9,625 before coming back to add a fifth digit.