In September, expectations were sky-high for a fresh round of easing from Japan's central bank. Fast forward to year-end and stimulus hopes have been indefinitely postponed.

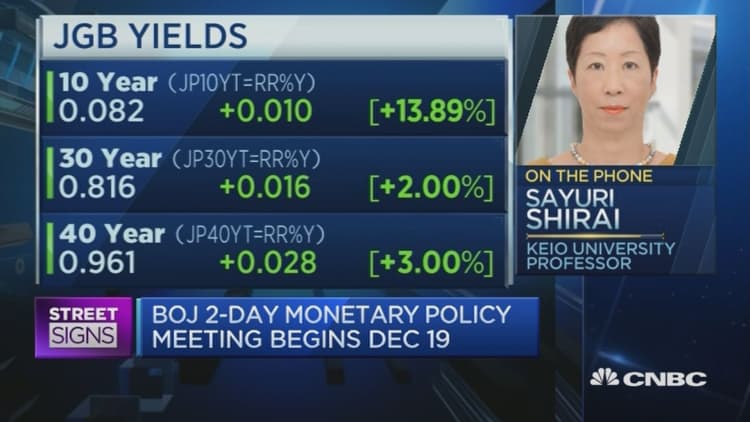

No action is expected on Tuesday, when the Bank of Japan (BOJ) concludes a two-day policy meeting. A recent Reuters poll of 15 analysts predicted the central bank will maintain the negative 0.1 percent interest rate imposed on banks for some excess reserves, keep the 10-year Japanese government bond (JGB) yield target at around zero, and keep annual rises in JGB holdings at 80 trillion yen ($676.9 billion).

"We stick by our call that the BOJ will leave its rates targets unchanged for the foreseeable future," echoed economists at Bank of America Merrill Lynch (BofAML) in a recent report.

Indeed, much has happened since September—the yen has lost 15 percent against the greenback, the benchmark Nikkei equity index and Japanese government bond (JGB) yields have spiked, future U.S. economic policy looks shaky under President-elect Donald Trump, the Federal Reserve has raised interest rates for the second time in a decade and predicted three more hikes next year.

Instead of tinkering with rates, the focus of Governor Haruhiko Kuroda's afternoon press conference will likely be on JGBs and the bank's economic outlook.

"The world will be specifically watching whether the zero percent yield anchor for 10-year JGBs is a hard and fast line in the sand, and if so, whether the BOJ will unequivocally commit to JGB purchases to that end," Mizuho Bank said in a note on Monday.

"It could also discuss at the meeting to implement the fixed rate outright purchase, a new tool introduced in September to contain rise in JGB yields," said Kowhai Iwahara, economist at Natixis Japan Securities.

On Sept 21, the BOJ said it would make yield-curve control a centerpiece of its new policy framework. It would buy 10-year JGBs so that the yield would hover around zero percent while keeping a lid on short-term rates. Additionally, the central bank abandoned its target for expanding the monetary base.

Meanwhile, the BOJ could also upgrade its economic assessment on Tuesday following a string of positive data.

The yen's decline has helped November export volumes, which hit a two-year high according to data released Monday, and brightened the outlook for manufacturers, as revealed by the central bank's December Tankan survey last week.

While inflation remains well below the government's 2 percent target, the outlook has significantly improved.

Large expenditure on public work projects, a part of August's 28.1 trillion yen fiscal stimulus package, is anticipated to support economic growth from the beginning of 2017 and in turn, prop up inflation, supported by a weaker currency, explained Iwahara.

Going forward, the central bank's policy dynamic could change from easing to tapering as a weaker yen and fiscal stimulus fuel inflation expectations. The fact that the central bank owns large chunks of the bond market already may also limit its ability to intervene, and consequently push yields higher.

"The room for additional JGB purchase has fallen with a 37.9 percent share of outstanding amount in the third quarter, the BOJ could arguably let interest rates rise," Iwahara said. But timing will be key, he warned. "A premature rate hike could also increase the risk of a stronger yen, making it more difficult to meet the inflation goal."

BofAML expects Kuroda to quash expectations of an early rate hike on Tuesday and reiterate that the bank is prepared to use fixed-rate operations as needed, with unlimited capacity for purchases." As the amount of outstanding bonds shrinks, the central bank will likely be able to taper purchases, even while maintaining yield targets, BofAML continued.

"As such, by the spring we think the BOJ will modify the now largely cosmetic quantitative guidance for the pace of its JGB purchases, possibly in April."