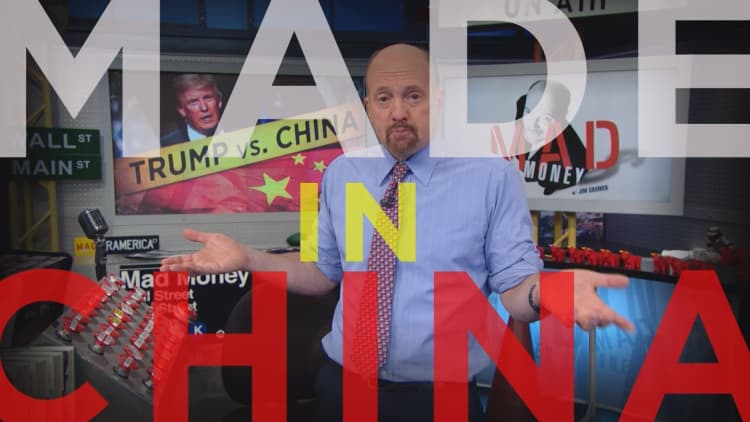

Jim Cramer explained President-elect Donald Trump's behavior towards China by clarifying that he does not want a trade war.

"It is that he believes we are already in a trade war, one that the Chinese are waging against us. And it's not that he wants to retaliate — it's that he wants to win," the "Mad Money" host said.

Trump believes that the Chinese have had their way with the U.S. endlessly, Cramer said. It's as if the U.S. are "lapdogs" who are willing to let them take away U.S. manufacturing jobs and don't put up a fight.

Cramer expects the positives to U.S. business under Trump — deregulation, repatriation and lower taxes — will be partially offset by the fact that it will be harder to ship jobs to another country. That is the real risk factor to Trump.

However, this doesn't mean investors should sell all stocks with exposure to China.

"You just need to recognize that you can't pay as much for them knowing that Trump is willing to play hardball," Cramer said.

The market has a powerful incentive to continue heading higher, even after its remarkable run, and Cramer expects analyst recommendations to weigh in significantly for the rest of the year.

Usually analyst opinions don't sway the direction of the stock market. But in moments like these, Cramer says investors should anticipate analyst recommendations, because the opinions will have the potential to move the market.

"We are in the sweet spot where analyst upgrades can make any stock roar higher. Now that you see how the game is played, you need to 'get some,'" Cramer said. "I think there will be plenty more of these to come in the last two weeks of the year."

Two analysts were also fighting over the stock of Cimarex, prompting Cramer to dig a little deeper and decide which one was right.

Cimarex is the oil and gas exploration and production company with assets in Oklahoma and Western Texas. Wells Fargo downgraded the stock to "market perform" from "outperform" and lowered its price target on Friday. At the same time, Goldman Sachs upgraded it to a "buy" from "neutral" while significantly raising its price target.

Ultimately Cramer sided with the bulls at Goldman. It is true that a rising tide has lifted all boats in the exploration and production space. Even as he expects things to become more difficult going forward.

"The decisions are getting tougher in the oil and gas space after the monster run these stocks have had in the past month, but when you consider both the pros and the cons, I still believe that a stock like Cimarex is worth owning," Cramer said.

While some segments of retail are alive and well, Cramer can't ignore the pain that department stores like Nordstrom are in.

For years, traditional mall-based retailers have struggled desperately to keep up with Amazon, and have made big moves to build out their omnichannel business to compete.

Unfortunately, for some retailers, it simply wasn't enough.

"The traditional department store seems to be in real trouble, and it's not just Nordstrom," Cramer said.

Ionis Pharmaceuticals announced positive phase 3 clinical trial results for an orphan drug that treats a pair of rare metabolic disorders that currently have no known cure.

However, with the stock up more than 56 percent since the election, Cramer spoke with Ionis' CEO Dr. Stanley Crooke to find out what could be in store for the future.

Dr. Crooke explained the significance of the drug, stating "We are really excited about this new chemistry because we think it could take the doses that we use for targets in the liver down to as low as a milligram a week … So, it's a significant advance in potency, safety, convenience and many other things."

In the Lightning Round, Cramer gave his take on a few stocks from callers:

Masco Corp: "I like Masco, but the fact is their products are sold at Home Depot, and I think Home Depot is taking share from Lowe's and Sears, which is a share don't-er. We are buying HD."

WEC Energy Group: "It's good but I'm not recommending many utilities other than American Electric Power, AEP. And that is in part because they may not have to transfer all of their coal plants into nat gas."