Wall Street is chatting about how the incoming Trump administration seems to be gearing up to get aggressive on trade, something that worried market pros during the election.

A catalyst for that talk was the appointment Wednesday of outspoken China critic Peter Navarro to head a new White House office overseeing American trade and industrial policy. There were also reports that President-elect Donald Trump was considering a 5 percent tariff on imported goods.

Both of those factors gave momentum to speculation that a House of Representatives proposal for a border-adjusted tax, on all imports, would actually have more support than expected.

For the most part, traders said the concerns were not reflected in the stock market, but the Mexican peso and some other emerging market currencies were weaker.

Art Cashin, UBS director of floor operations at the New York Stock Exchange, said he did not see the stock market reacting to the appointment, but traders were definitely looking at it. "I think they're scratching their heads about it to some degree, but I don't think it's fully there. Where I think there might be some action pre-emptively is in Asia," said Cashin.

But David Lutz, head of ETF trading at JonesTrading, said the selling in retailers and apparel makers in recent sessions has been partly related to the idea that imports could be taxed at the border. The House proposal would put a tax on all goods and services coming into the U.S., but U.S. exports would not be taxed in an effort to encourage more manufacturing in the U.S.

Retailers sold off mainly on worries about weak sales on Thursday, but Lutz said the tax concern was in the background. The consumer discretionary sector was off 1 percent after an earnings miss and negative comments from Bed Bath & Beyond. NPD Group also said dollar sales in the first six weeks of the holiday season are 4 percent behind the same period last year.

But Lutz said the talk about the proposed import tax also picked up Thursday. Retailers import 95 percent of the shoes and clothing sold in America, and many other goods, such as electronics are also imported.

"It all accelerated with the Navarro appointment. Before the border tax was just a hypothetical and now it looks like it could be become a reality," he said. "I think it's just an unknown people are trying to position for. The market can handle bad news. It's the unexpected that bothers it."

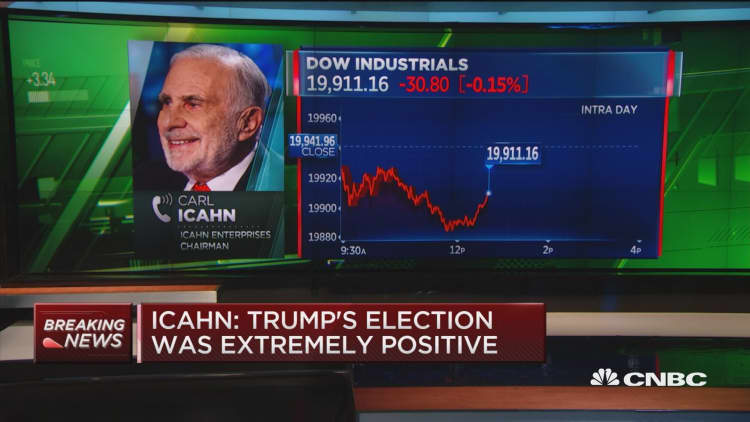

Investor Carl Icahn, newly appointed Trump advisor on regulation, weighed in on trade and China in an interview Thursday on CNBC.

"If you're asking me am I concerned about the market on the short term. Yeah I'm concerned about it," Icahn said. "You can look at so many factors here that you have to worry about. Obviously, if you get into a trade war with China, sooner or later, I think we're going to have to come to grips with that, maybe it's better to do it sooner, but that's not my decision at all. I don't get involved with that."

Andres Jaime, Barclays global foreign exchange and derivatives strategist, said he believes the trade concerns showed up in the Mexican peso Thursday, which was down about 1 percent, and that possibly some other emerging market currencies were reflecting that. Some traders pointed to the Australian dollar as a currency to watch since it is directly impacted by the Chinese economy.

"The important message is that's the way they are thinking, and it seems they really do think the way to go is to impose some restrictions on trade so probably the market was in a honeymoon period where (people were thinking) that wasn't going to be the case," said Jaime. He said both Navarro and Trump's Commerce secretary choice, Wilbur Ross, have taken protectionist positions. He added it is still not clear whether any tariffs or other trade actions are going to be implemented, but it has become a concern.

"They still need to outline a lot of the details, but it seems that between the rumors and some articles, it seems that their trade rhetoric is strengthening a bit. It's nothing to panic about yet because there's still uncertainty, but I would say it has strengthened somewhat," Jaime said.

Shundrawn Thomas, Northern Trust Asset Management's head of funds and managed accounts, said he does not take one appointment as an indication that the new administration will take aggressive actions that could start a trade war though the market may see it as a signal of policy direction.

Thomas said the market is much more focused on the promise of Trump's stimulus plans and tax cuts, and there do not seem to be many other catalysts to move the market until after the new year. "I think that will continue to carry the market positively into the new year," he said.

In the bond market, yields were higher Thursday. The auction of $14 billion in five-year Treasury Inflation Protected Securities supply was very strong, with strong participation from nondealers.

"There were record nondealer awards because investors have bought into the reflation trade idea and are willing to pay up for inflation protection," said Ian Lyngen, head of rate strategy at BMO.

He said Trump's trade appointment was getting some talk in the bond market but little else. "No one's really trading it because no one was really trading," he said.

"I think we already have saber rattling between the incoming administration and China and a more intense round of saber rattling would certainly get the market's attention," he said. "It's not clear to me that that's impetus for breaking the range that the Treasury market is holding. If something happens, yes. Otherwise it's just politics."

Peter Boockvar of The Lindsey Group said he expects the market to begin focusing on things like trade in the new year, after stocks have rallied so much since the election on the Trump trade.

"I get all the enthusiasm with Trump but getting from here to there, there's a lot of politics and a lot of people protecting their turf along the way," he said. "People will start looking at what's going to happen with more of a microscope."

The Dow closed Thursday at 19,918, off 23 points, and the was down 4 to 2,260.

Friday starts a five-day period where stocks have historically been mostly higher, but not up by much. The Dow, in the last five trading days of the year, has been up 56 percent of the time since 1980, with an average gain of just 0.3 percent, according to analytics firm Kensho. The Dow is now about 0.4 percent away from 20,000.

As for the S&P 500, it has been up 58 percent of the time in the final five days of the year since 1980, with an average gain of 0.4 percent.

There is consumer sentiment and new home sales Friday, both at 10 a.m. ET.

Correction: The S&P 500 closed at 2,260 on Thursday. An earlier version misstated the figure.

Disclosure: NBCUniversal, parent of CNBC, is a minority investor in Kensho.