While President-elect Donald Trump slapped GM and Ford for building cars in Mexico, the biggest automotive import from Mexico ends up not being cars — it's vehicle parts.

Under NAFTA, the automotive industry increasingly became intertwined between the U.S., Canada and Mexico, resulting in an auto parts manufacturing boom south of the border.

The impact of that is clear in U.S. trade data. For instance, in the 10 months ended in October 2016, automotive vehicle and parts imports from Mexico totaled $89.6 billion, dwarfing the next biggest import nations, Canada with $54 billion and Japan, at $44 billion.

While vehicles were the main imports from Canada and Japan, more than half — $46.8 billion of the automotive-related imports from Mexico — were vehicle parts in that 10-month period. U.S. government data show that car parts imports into the U.S. nearly doubled in the past five years.

"It's all to do with the fact it's a global industry. This is part of the supply chain. It's U.S. producers that produce in the U.S. It's foreign producers that produce in the U.S. It's all part of a chain," said Diane Swonk, CEO of DS Economics. Swonk said non-U.S. auto producers in the U.S. also import from Mexico, reducing imports of parts from their home countries.

The North America Free Trade Agreement, adopted in 1994, was intended to create a North American market where goods could move across borders between the U.S., Canada and Mexico tariff-free.

As a result, Mexican auto-related manufacturing has grown, while there have been reductions in Canada and the U.S. Canada remains the largest exporter of passenger vehicles to the U.S. — at $37.8 billion for the first 10 months of 2016. That compares with $31.4 billion from Japan. Mexico exported $19.3 billion in passenger vehicles and another $23.5 billion in trucks in the same period. In 2014, the U.S. says Mexico surpassed Canada as the biggest overall vehicle exporter, of both cars and trucks, to the U.S.

Trump has for months been highly critical of Ford's plan to move more manufacturing to Mexico. On Tuesday, the company announced that it was now scrapping plans for a $1.6 billion plant in Mexico and instead would invest $700 million in the Flat Rock assembly plant in Michigan.

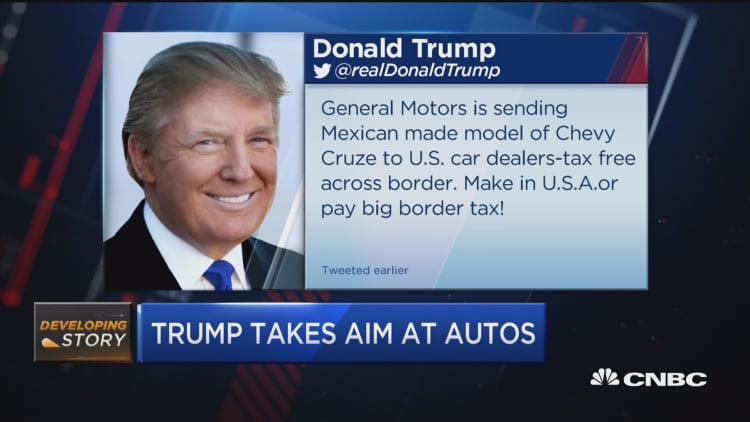

Just before the Ford announcement, Trump criticized its rival General Motors in a tweet, for producing the Cruze in Mexico and then importing it into the U.S. tax free. "Make in U.S.A. or pay big border tax," the president-elect said in a post on Twitter.

GM later said that it built the Cruze hatchback in Mexico for global markets with a very small amount sold in the U.S. Of the 190,000 Cruze cars sold in the U.S., 185,500 were built in Lordstown, Ohio, the company said.

The Cruze and the small car Ford was expecting to build in Mexico have fallen out of favor, as cheaper gasoline has sent drivers toward SUVs and other larger vehicles. GM is expected to curtail a third shift in its Lordstown plant, eliminating 1,250 positions there. Ford said it made the decision to halt the plant because of business reasons.

Trump's criticism doesn't stop other manufacturers from building up operations there, including Toyota, Audi and BMW.

As for parts makers, Mexico is a world-class producer, with U.S.-based TRW, Eaton, and Honeywell among the companies with units operating in Mexico.

In an International Trade Administration report, it was noted that Mexican-produced parts are 10 percent cheaper than those in the U.S., and Mexico has been aggressive in building trade deals in Latin America and Asia.

Mexico is the third-largest U.S. trade partner, and there was a $58 billion trade deficit on goods in 2015. That is about the same size as the total deficit in the automotive sector trade.

According to the U.S. Trade Representative's office, the vehicles category was the biggest Mexican export to the U.S. in 2015, totaling $74 billion, and exports from the U.S. totaled just $22 billion.

Mexico has more than 400 parts-producing plants, according to U.S. government data. More than 2,000 companies make up the industry and 65 percent of those are foreign owned. In 2015, 60 percent of the $5 billion foreign direct investment in Mexico's automotive industry went into parts manufacturing, according to the U.S. government.

Trump's idea of a border tax would complicate life for automakers, even more due to their dependence on foreign parts. The president-elect has said goods sold back by U.S. companies into the U.S. should be taxed by 35 percent at the border, but the House's proposed corporate tax overhaul includes a plan to tax all imported goods and services with no tax on exports.

Proponents say the proposed border-adjusted tax is similar to valued-added taxes in other countries, and that it would create more jobs in the U.S. and make U.S. manufacturing more competitive. Opponents say it could complicate trade, create inflation and result in potential retaliation from trade partners.

"It's truly a global supply chain. Things are produced in lots of different places and assembled in lots of different places. It's hard to know what the foreign content of a car is, what percent of a car assembled here is produced somewhere else," said Mark Zandi, chief economist at Moody's Analytics.

"At the end of the day, the strategy is to create more jobs here in the United States. I think it's a failing strategy. It's not going to work. It's not going to make a difference. I don't think this changes the number of jobs that are in the vehicle industry four years from now."