With tech propelling the Nasdaq to another record high this month, Todd Gordon of TradingAnalysis.com sees Alphabet as the stock to bet on as tech gets back on its feet.

Shares of Alphabet have rallied 4 percent since the start of the year, while tech as a whole is up 2 percent to be the best performing sector so far this year. "We've seen [Alphabet] as well as the other tech stocks start to re-emerge as the market leaders in here," said Gordon on Tuesday on CNBC's "Trading Nation." "So I'd like to play [Alphabet] to the long side heading into earnings."

Looking at a chart of Alphabet, Gordon points out that the tech giant is currently sitting near its late October highs of over $830, which the trader is using as a key level to watch. "It looks like with the tech strength that we have, we should be able to poke through and make new highs," said Gordon.

With Alphabet reporting earnings in late January, implied volatility, or the price of options, for Alphabet has risen. Since options are now more expensive for Alphabet, Gordon wants to sell puts instead of buying calls to take advantage of the fact.

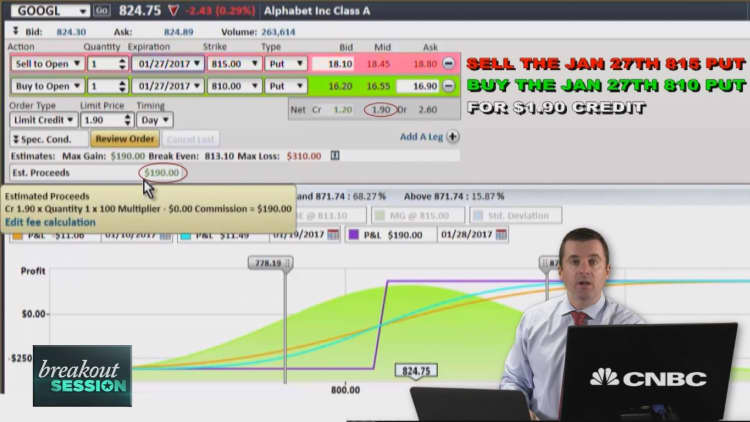

As a result, Gordon is selling the Jan. 27 weekly 815-strike puts and buying the Jan. 27 weekly 810-strike puts, leaving him with $1.90 credit per share. If, on Jan. 27, Alphabet closes above $185, Gordon would keep the $1.90 credit he has on the trade. But if Alphabet closes below $810 on that day, then Gordon would see a maximum loss of $3.10.

The breakeven point on the trade $813.10. This means that he will make money so long as the tech stock does not fall 1 percent or more from its Wednesday trading levels.