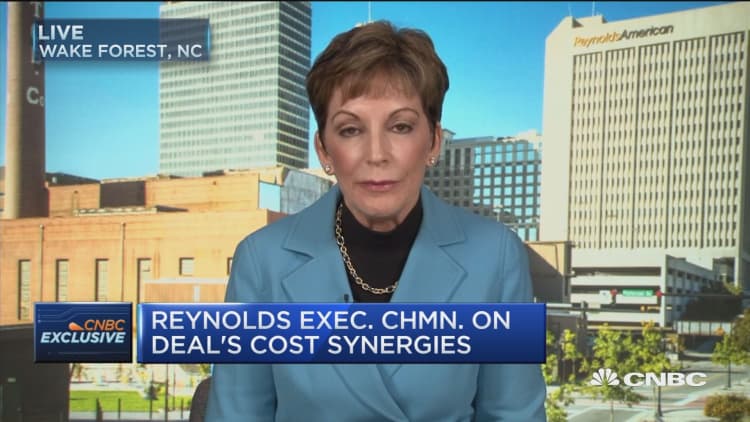

British American Tobacco's $49.4 billion takeover of Reynolds American is a benefit for both companies despite criticism that Reynolds could have gotten a better price, Reynolds American Executive Chairman Susan Cameron told CNBC on Tuesday.

"This was a hard-negotiated sweet spot between the two sets of shareholders," Cameron told "Squawk on the Street." "We feel like we did hit the sweet spot. It is a win-win for both sets of shareholders."

According to Cameron, shareholders of the newly combined tobacco giant will receive "almost a 50-50 component between cash and equity, to participate in the future value of the group."

British American's acquisition of its U.S.-based competitor will make the conglomerate the largest listed tobacco company in the world. The move marks British American's return to U.S. markets as well as Reynolds' introduction to the global and emerging markets space.

"This is really a strategic combination," Cameron said.

And contrary to most mergers, which tend to reduce jobs, Cameron said this one could actually do the opposite. Or at least not threaten U.S. workers, according to the executive.

"The great majority of jobs here and certainly all of our facilities will remain operating for the U.S. business," she said. "What we are also excited about is looking at the potential for Reynolds to play a larger role in group activities and looking for the potential of new jobs."

Reynolds' stock was trading at record highs Tuesday morning, up just over 3 percent, on track for its best daily performance since October 2016.