House Ways and Means Committee Chairman Kevin Brady on CNBC Friday warned that cutting the "border adjustment" measure in the overall Republican corporate tax reform plan would have "severe consequences."

The GOP proposals under the banner "A Better Way" — spearheaded by Brady and House Speaker Paul Ryan and released over the summer — call for a reduction of the federal corporate rate from 35 percent to 20 percent, a switch to a territorial system, and border adjustments.

It's the border adjustments, exempting exports and taxing imports, that's really become a hot-button issue.

On Monday, Donald Trump called the tax "too complicated" in an interview with The Wall Street Journal. However, on Tuesday, he told Axios, a new media start-up from the co-founders of Politico, that the idea is "certainly something that is going to be discussed."

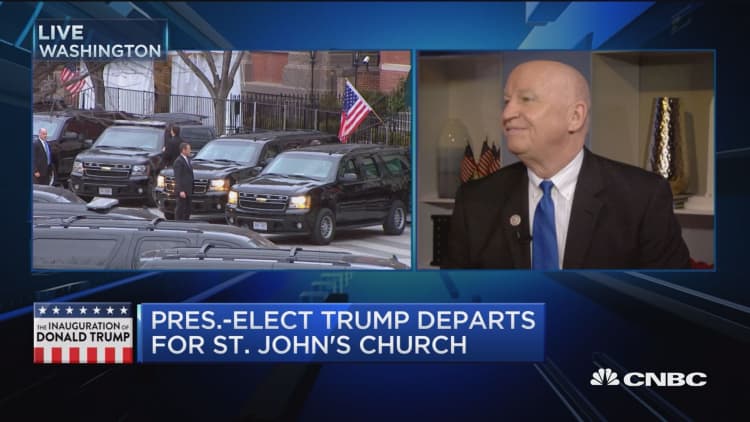

"There's almost no question that without that, a couple of bad things, pretty severe consequences" would happen, Brady told "Squawk Box" on Friday, the morning of Trump's inauguration as the nation's 45th president.

"You won't tax imports and exports equally ... you'll still have a tax advantage for foreign products," the Texas Republican said.

Pushing the GOP tax overhaul through without the border adjustment, he said, "It will complicate the code further because the border adjustability simplifies it in an almost revolutionary way."

Trump has given "very positive" feedback, the House Ways and Means chairman said. "I will give him big kudos, because he and his team just dove into this tax reform."

"We admit, we're throwing big, revolutionary changes to get us back into the game," Brady said.