Political cross-currents could either mute or boost companies that report next week, Jim Cramer says.

"The...pro-business tripod are potent as we hit the heart of earnings season. But so are actual numbers. Be ready for real opportunities next week," the "Mad Money" host said, referring to President Donald Trump's platform of deregulation, repatriation of money overseas and lower corporate taxes. Cramer believes those elements will be good for the stock market in the long-run.

With this in mind, he outlined the stocks on his radar next week.

Monday: Halliburton, McDonald's

Halliburton: As a classic Trump stock, this oil service company is primed for Trump's presidency. However, Cramer warned that it could report a less-than-perfect quarter.

McDonald's: With a huge foreign business, Cramer fears that McDonald's could be impacted negatively by Trump's pro-growth policies that will strengthen the dollar. That means earnings estimates may need to come down. If CEO Steve Easterbrook focuses on technology, loyalty and luring in customers, Wall Street's reaction could be OK.

Tuesday: 3M, Lockheed Martin

3M: Voted by Cramer as one of the stocks that could help the Dow reach 20,000, he recommended buying shares both before and after it reports.

Lockheed Martin: Cramer is interested in seeing if Lockheed will trim its forecast because of the price cut to the joint strike fighter, which was done to concede with Trump's wishes. If it doesn't guide down, Cramer said the stock could fly high.

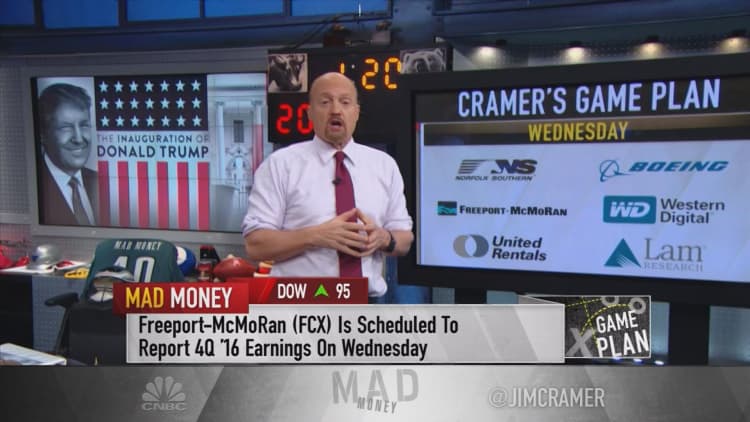

Wednesday: Norfolk Southern, Boeing, Freeport-McMoRan

Norfolk Southern: With the stock performing strongly, Cramer wants to be careful going into the quarter. When stocks run up into earnings, it is very difficult for them to rally afterwards, even if they deliver terrific numbers. He suggested selling the stock beforehand.

Freeport-McMoRan: Copper, gold and oil play Freeport could benefit from acceleration in the global economy. This stock has also run up dramatically, but Cramer blessed it for buying if you believe that both America and China are headed higher.

Thursday: Caterpillar, Alphabet

Caterpillar: Deemed one of the infrastructure plays that will last through the early days of Trump's administration, Cramer warned that Caterpillar has been hurt by the strong dollar. If Trump picks a bone with the Chinese on trade, it could be a double-whammy. With so many cross-currents, he didn't recommend it.

Alphabet: Cramer called this one controversial because it needs to rein in costs from other bets, or find a way to generate accelerated revenue. It could also be a winner in Trump's administration because it has lots of cash overseas.

"I would buy Alphabet aggressively if the stock comes down after the quarter precisely because of that cash hoard's possibilities," Cramer said.

Friday: Honeywell

With Dave Cote as the outgoing CEO, Cramer thinks he will want to go out on a high. However, the last few conference calls have sounded more downbeat than Cote may have wanted them to be.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com