Snap – the owner of ephemeral messaging app Snapchat – is "total junk", worth a small fraction of its current valuation, and should be avoided by investors when it goes public later this year, one analyst has warned.

"We are at the tail end of the social media boom. Novelty is giving way to fatigue," Trip Chowdhry, managing director of equity research at Global Equities Research, wrote in a note on Sunday.

"Fundamental investors should avoid the IPO. Snapchat is a total junk, hyper-inflated."

Chowdhry is a well-known bear on many technology stocks and in December issued a note suggesting Twitter is "toast" as a company with the stock not even worth $10.

His negative sentiment is echoed in Snap and said the company is not worth $500 million, even calling this valuation "generous". Snap is reportedly set to go public this year in an initial public offering (IPO) that could value the firm as high as $25 billion.

Chowdhry said investors should avoid buying shares in the firm and speculative traders who decide to play the IPO should get out in the first hour.

‘Hot air’

The analyst gives several reasons for his bearish call. Firstly, Chowdhry said "durability is absent" with the company, citing Groupon, games maker Zynga, camera firm GoPro, and fitness wearable company Fitbit as examples of firms that have struggled.

But Snapchat is known for having some very attractive aspects of the company, particularly the attraction of millennials to its platform and engagement with videos. When asked by CNBC if he thinks this makes it different from other social media companies, the analyst said the previous companies he mentioned all had their own "uniqueness" too but still struggled.

"All the junk IPOs I mentioned had their uniqueness too. Remember Groupon – group buying; Zynga - social gaming; GoPro – action photography and a media company and drone company. These are all instruments of blowing hot air into a company before a collapse," Chowdhry told CNBC by email.

Social media advertising spend is also not getting consolidated but being spread across several players while total ad spend is growing at a slow rate, the analyst noted, saying that the industry is in "zero-sum economics". This is another reason investors should be weary.

Global media owners' net ad sales are forecast to grow by 3.6 percent in 2017, compared to 5.7 percent in 2016, according to a report by MAGNA, IPG Mediabrands' research arm.

‘Enormous’ opportunity for Snap

But Chowdhry's views appear to be a minority view amid a lot of excitement for Snap's IPO and some analysts have questioned his call that the company is not worth $500 million.

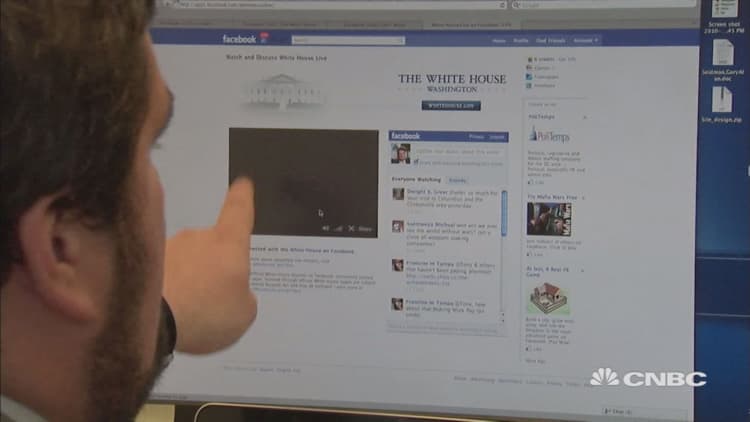

Neil Campling, Neil Campling, head of global TMT research at Northern Trust Capital Markets, said when Facebook paid over $20 billion for WhatsApp in 2014, with the messaging app having no revenue, it was seen as an "extremely valued deal", but is now considered an "exceptional acquisition." The same is true of Instagram.

"Now Snapchat is seen as the number one form of social video. Yes, Live and Instagram videos are in the market but what that does is expand awareness and expand the addressable market," Campling told CNBC by email on Sunday.

CNBC reported last week that Clients of WPP, the world's largest advertising firm, spent $90 million on Snapchat last year, three times what the company had forecast. WPP CEO Martin Sorrell told CNBC that it means Snapchat's revenues for 2016 were likely higher than the $350 million the market expected. But the WPP head also said that ad spend on Snapchat from clients is still small compared to $5 billion for Google and $1.7 billion for Facebook last year.

Still Campling said Snap's potential is huge.

"WPP went from zero on Google to $5 billion a year in 12 years, zero on Facebook to $1.7 billion in 6 years. Snapchat is likely on a faster growth path than either Google or Facebook. Their opportunity is enormous and just beginning," Campling told CNBC.