President Trump attempted to fast track the Keystone and Dakota Access pipelines on Tuesday, proving to Jim Cramer that this will be the most pro-petroleum administration in American history.

However, that doesn't mean the price of oil is about to skyrocket.

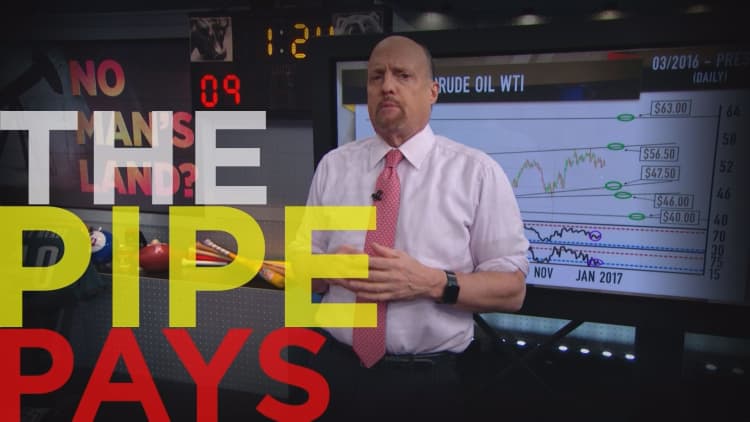

"While the oil producers will definitely benefit from deregulation and the approval of new pipelines, the actual outlook for the price of oil is more murky," the "Mad Money" host said.

Ultimately, Cramer likes oil stocks in this environment, but warned that investors need to believe they can do well, even if crude stalls out. His top pick was Magellan Midstream Partners.

"This is still one more reason why I think the pipelines are the best way to play the oil patch," Cramer said.

Cramer also found five themes that can continue to roar higher and rebuke even the biggest doubters of the rally. They were housing, earnings, deregulation, higher oil, higher rates and the strength in materials stocks.

"Aside from the deregulation component, most of this rally would have occurred regardless of Trump's initiatives, which means this move might be a lot more sustainable than the doubters would have you believe," he said.

D.R. Horton reported strong earnings on Tuesday and confirmed orders were up 15 percent. This matters because mortgage rates went up this quarter too. Typically when rates go up, housing gets hit. Instead, the largest homebuilder had a surprisingly strong level of confidence. Horton even said better employment will lead to better housing demand.

Shares of medical device maker ResMed soared more than 9 percent on Tuesday after reporting a strong quarter, with revenues up 16.7 percent year-over-year.

ResMed sells products to combat sleep apnea and chronic obstructive pulmonary disease. It makes continuous positive airway pressure machines — known as CPAP machines — that help people with sleep apnea not gasp for air when they sleep.

Cramer spoke with ResMed's CEO Mick Farrell, who said the company intends to use data from more than 1 billion nights of sleep for patients to create actionable information that patients can use to manage their own care, physicians can use to help patients and insurance companies and governments can use for population health management.

"The opportunities are boundless in what we can do with this," Farrell said.

Deluxe Corp has also transitioned into an astounding rebound story. Somehow the century-old payment solutions business best known for printing checks has picked up 25 percent gain in 14 months.

The company's investments in brand awareness to let customers know that they are more than just a check company and were now a one-stop shop for the processes that many small businesses need, have paid off.

It was clear to Cramer that the execution of management was fabulous, too. With the stock at $73, Cramer thinks it is a steal.

"I believe that small business will be the driver of growth going forward, not the big companies Trump has been meeting with, and Deluxe has solutions that they need in order to expand," Cramer said.

Cramer has been a skeptic of the value of unlimited trade for a very, very long time, but says he won't recommend Ford or General Motors if they close their foreign plants.

"You can't have your protectionist cake and eat it, too. Meaning, when it comes to trade policy there is no scenario where everyone is a winner," Cramer said.

President Trump met with major automaker CEOs on Tuesday to urge them to build more plants domestically, saying these plants could ignite economically depressed towns and spur manufacturing in the U.S.

However, if the president only goes after domestic automakers then these companies will be at a disadvantage to the foreign competition who can build cars in places like Mexico. Cramer feared American auto companies could become losers.

In the Lightning Round, Cramer provided his take on a few stocks from callers:

Chesapeake Energy Corporation: "I like that. They just paid off the preferred, they cleaned up the balance sheet. It's going to be the year of natural gas. I say buy, buy, buy. We were talking about buying that for my charitable trust. You've got a good one."

Inovio Pharmaceuticals Inc: "I don't like the vaccine business, but more importantly I think that when you are in the crosshairs of the president on this drug issue it doesn't seem to end well."