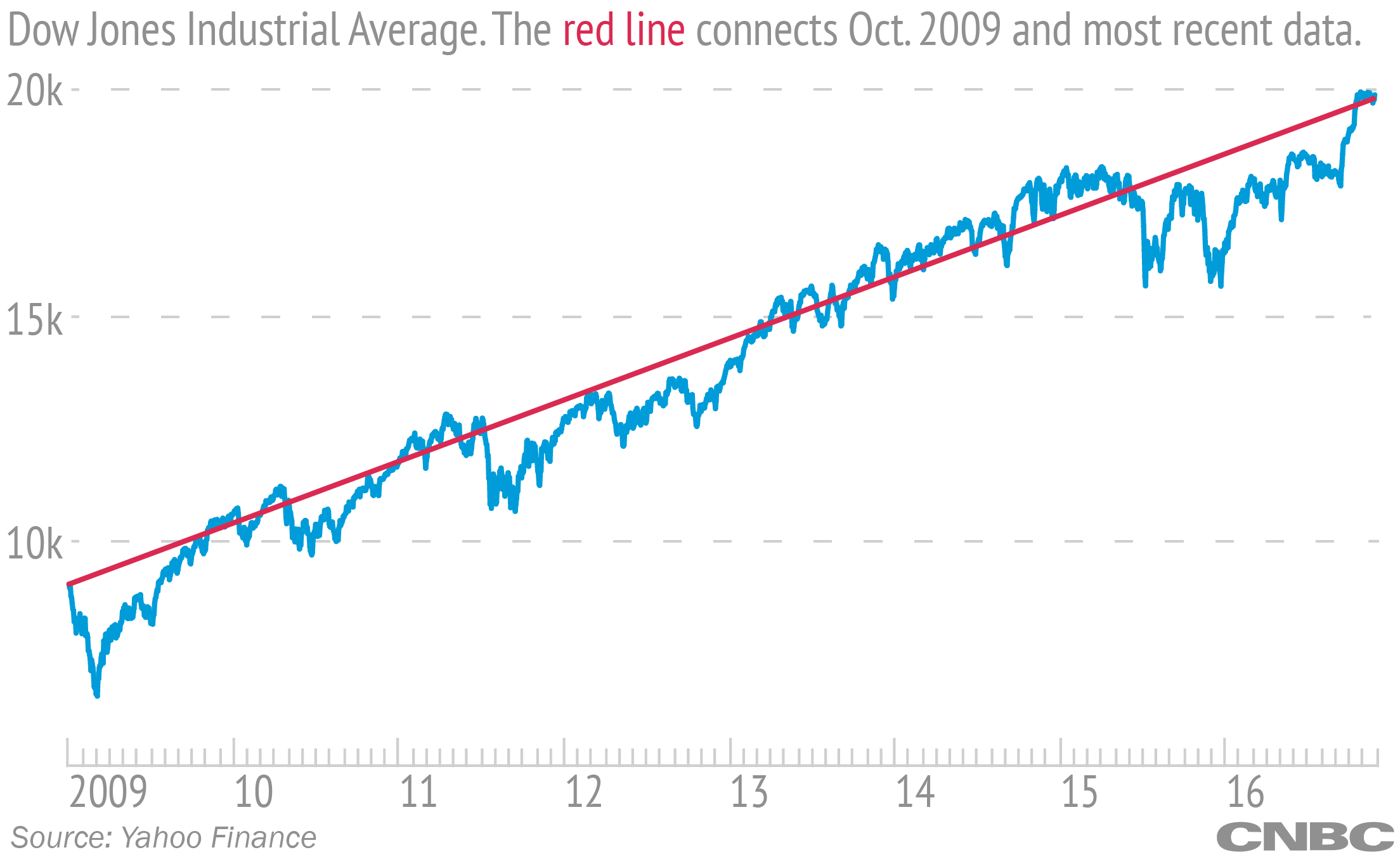

As investors and the news media trumpet the Dow Jones Industrial Average hitting 20,000, it's important to remember that a lot about the economy hasn't changed at all since October 2009, when the Dow was last at 10,000.

Let's run through a few examples.

People's expectations for their personal finances in 2017 are up slightly, but not a whole lot different than they were in October 2009:

When you ask people to guess the chances that they might lose their job in the next five years, the answer you get now is not much different than it was seven years ago:

People haven't changed their view on whether Social Security or their pension will be adequate for their retirement:

It's been well-reported that almost all the gains in the stock market go to the country's wealthiest citizens. First, notice that fewer Americans own stocks now than they did in 2009:

And the current value of stock market investments for the 25th percentile has moved up much less than for investors at the 75th percentile:

Compared with October 2009, fewer people actually think business conditions will get better. This makes sense given how bad the economy was back then, leaving "up" as really the only direction to go.

Plus, investor confidence is slightly higher now than it was then, at least globally:

And investor bullish sentiment is basically the same between now and then:

And more broadly in the labor force, we have seen a steady decline in the participation rate, though economists disagree about the root causes:

The charts show very briefly that while for one type of investor, Dow 20,000 is a great thing, it doesn't mean everybody has gained equally. Nor does it mean everything is better, in terms of reality or expectations to come.