The man who built gold towers is now driving up the price of gold because of the uncertainty he brings to the White House.

Gold futures prices hit a more-than-two-month high Monday, and they're set to elevate further.

Gold rose about 1 percent Monday, with futures for April settling at $1,232.10 per ounce.

"It's looking the best it's looked in several months, from a technical perspective anyway," said Jim Wyckoff, senior analyst at Kitco. "We could see $100 more on the upside easily."

President Donald Trump's trade and currency comments have driven investors to seek safety in the metal. That trade got another boost Monday after Trump said Sunday that the effort to dismantle — and replace — Obamacare could take until 2018, raising concerns that his entire agenda is now being pushed back.

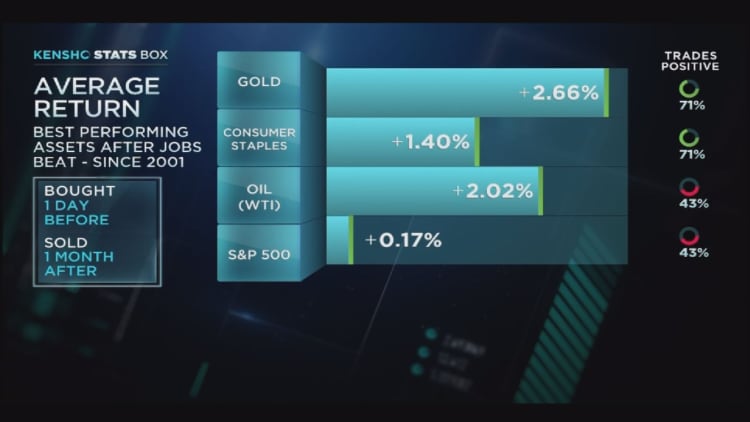

The market also responded to Friday's employment report, which showed strong job creation but soft wage growth. Traders took that as a sign that inflation may not be picking up, and the the Federal Reserve will not need to raise interest rates until later in the year.

"Aside from Friday's payroll data, I think there's a general change of heart on Mr. Trump's policies, or how the market is going to perceive it. What we're increasingly experiencing is the Trump agenda may not be implemented as quickly as the market thought. It's going to be challenging," said Bart Melek, head of commodities strategy at TD Securities.

The stock market has rallied on the idea that tax reform would be approved this year, and in an interview Sunday before the Super Bowl, Trump said he thinks there will be tax cuts this year. But already in Washington there is disagreement over a key element of the House corporate tax reform proposal — a border adjusted tax that would put a levy on all imports but not exports.

"Realistically, I think the market is looking at it, and saying it may not be particularly easy sailing through the GOP-controlled Congress," Melek said. "So the idea we're going to get all this stimulus, lickety split, at a time when the U.S. economy is already approaching full employment may not materialize for a while."

Stocks were slightly lower Monday after surging Friday. Typically, gold and stocks do not go higher at the same time. "That's kind of an anomaly. That's a good thing for gold, because it suggests that when the stock market does correct, it's going to give gold an added boost. It just seems to be that the stock index is due for a pullback," said Wyckoff.

Trump has taken some of the wind out of the dollar recently, and the market is also adjusting to a new U.S. stance on the currency. Both he and Treasury secretary nominee Steve Mnuchin have said the dollar is too strong. Last week, Trump advisor Peter Navarro called out Germany for allegedly keeping the euro low. China and Japan are also on the list of countries said to be keeping their currencies too low, and Trump has called trade with Mexico unfair.

"When you're accusing all your trading partners of manipulating currency, that implies there might be some kind of policy in the offing," said Wyckoff.

The Kitco analyst said there's a safe haven trade just based on a general uncertainty around Trump. "He's perceived by many to be a kind of loose cannon," Wyckoff said.

While the market is focused on Trump, analysts say it has barely begun to focus much yet on the spring election in France, where candidate Marine Le Pen says she would get rid of the euro.

Trump is meeting with Japanese Prime Minister Shinzo Abe "later this week, and he has mentioned that maybe Japan is a currency manipulator," said Wyckoff. "Trump may stand up and say that. This is a new situation for us. You have a guy who is president who says exactly what he's thinking. That hasn't been the case in the past. It's so jolting. It's a surprise to the marketplace, and markets don't like surprises."

Kevin Grady, president of Phoenix Futures and Options, said he thinks gold could keep rising, but he's watching for broader investor involvement through ETFs, like GLD, the SPDR Gold Trust ETF. GLD was up more than 1 percent Monday, while the VanEck Vectors Gold Miners ETF, GDX, was up more than 3 percent Monday afternoon.

"I don't think we're looking at $1,500 gold. It seems to be a stable trade right now. I think watching ETFs is the key," said Grady. "What's starting to happen now is we're starting to put [long bets] back into the market. The trade discussions Trump is having is making the market a little jittery."

Melek said flows into ETFs have just started to turn positive. "It's an inflection point. It stopped going down," he said.

Melek expects gold to average $1,225 per ounce this quarter, $1,250 next quarter and $1,275 in the second half of the year: "$1,300 is well within striking range."

Correction: Steve Mnuchin is the nominee for Treasury secretary. An earlier version misstated his status. Japan's prime minister is Shinzo Abe. An earlier version misspelled his first name.