When it comes to President Donald Trump's agenda to deregulate banks, Jim Cramer says investors are fixated on that everything has to go through Congress.

"That is the conventional wisdom, and it is just plain wrong," the "Mad Money" host said.

The president has freedom when it comes to how hard he wants to enforce rules, and Cramer interprets Trump's actions so far as signaling that he wants regulators to have a lighter touch. In the past, regulators have used the Dodd-Frank Act to come down hard on banks.

Those days are over.

If regulators allow banks to return more capital to shareholders in the form of buybacks and dividends, then Cramer doesn't care how much of Dodd-Frank gets repealed or how long it takes.

Cramer attributed the recent rally in bank stocks to this notion of deregulation. If the economy accelerates, he expects the stocks to skyrocket higher because the Federal Reserve will raise rates.

The same deregulation has also occurred in the oil and gas industry, as the Federal government has given the green light to both the Dakota Access and the Atlanta Sunrise pipelines. This is good news for stocks such as Energy Transfer Partners and Cabot Oil and Gas.

Cramer could only imagine what Trump can do in the National Labor Relations Board, EPA, FTC and FDA.

"Just about every regulator in Washington is about to get more business friendly, and these will ultimately be estimate-raising events for so many companies," Cramer said.

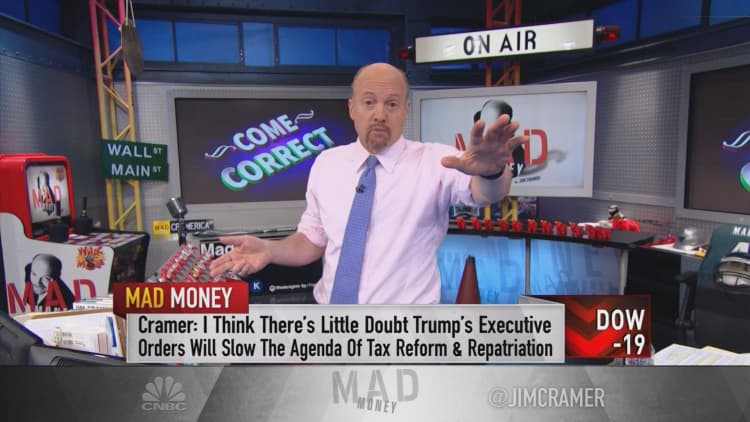

So, while many investors think a big, bad Trump-related correction in the stock market is coming, Cramer said to count him out. While Trump's recent executive orders will slow the economic agenda of corporate tax reform and maybe repatriation of foreign assets, Cramer thinks a big correction is less likely than others have suggested.

It seemed to Cramer that Congress will notbe able to move as quickly as Trump wants them to, and no one can figure out which executive order to move on first. First it was Obamacare, then it was instituting a travel ban, then it was corporate tax reform, then infrastructure, then tariffs.

"Way too many firsts, far too little planning," Cramer said.

With so many companies like McDonald's, Alphabet and Facebook reporting what appeared to be weak quarters at first that turned out to be strong, Cramer sees many buying opportunities out there.

Thus, regardless of political affiliations, the true stars of earnings season have been the companies themselves, not the president.

"You should indeed sell what you don't like. But only so you can buy what you do like if we actually get the kind of political sell-off that so many expect but maybe, just maybe, won't happen," Cramer said.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com