As stocks wobble and bonds sell off, there's an underlying crankiness that President Donald Trump won't deliver what financial markets want most when he speaks Tuesday night.

What they want is cold, hard facts. Facts on tax reform, facts on deregulation and facts on stimulus spending — facts on the types of policies that would support the post-election stock rally and expectations that the economy will kick into a higher gear. Trump speaks at 9 p.m. to a joint session of Congress.

"The odds of having a negative reaction to this evening are three-to-two," said Art Cashin, director of floor operations at UBS. There is a chance Trump could surprise positively. Just a few weeks ago, traders thought positive news would be a given.

"It's definitely an event risk. Nobody knows what he's going to say. That's one bridge we're going to get a across, and once we're through that, people are going to look at the top of his priority list," said Aaron Kohli, rate strategist at BMO.

The reason we've had no volatility is people are sitting back. They're making money. They're letting their positions ride. The ETFs and index funds have to buy.Doron Barnessglobal head of equity trading, Oppenheimer and Co.

On Tuesday, bond yields edged higher. Kohli said Trump may put tax reform and regulation near the top of his list. But he has not been pumping up infrastructure spending as much as the market anticipated, and it now seems like a 2018 event. He said the Treasury yield curve has been flattening as a result, reflecting less long term growth.

"The problem for the market is there's this firm belief that there is likely to be a honeymoon period that will end very quickly. We're going to get to the edge of it soon. The heavy legislative lifting that needs to get done needs to get done right up front, because the capacity to do it in 2018 is very limited, and I think those are the risks the market is looking at. It's really about where the emphasis is right now," Kohli said, referring to 2018 Congressional races.

Trump set the table for a night loaded with juicy nuggets for markets when he told a group of CEOs back on Feb. 9 that he would have a "phenomenal" tax plan in two to three weeks. In the minds of traders, that would be now, and there are no signs of such a plan.

"I think it would be presumptious to keep buying up here until you get more information. That's why the institutional community is looking forward to this," said Doron Barness, global head of equity trading at Oppenheimer and Co. "They need specificity. People can connect the dots, but if you look at what's been happening, we've had no volatility. The reason we've had no volatility is people are sitting back. They're making money. They're letting their positions ride. The ETFs and index funds have to buy."

The markets have been looking for a timeline that includes some sense of how tax cuts will be paid for. Instead, there are signs that the Trump administration could hit roadblocks. Market strategists said things would go most smoothly for tax reform if Trump supported the plan being put forward by the House. But that plan is already meeting opposition in the Senate, with some senators saying they will not back a key aspect — the border adjustment tax.

Utah Sen. Orrin Hatch, chair of the Senate Finance Committee, said on CNBC Tuesday that tax reform could have a hard time gaining approval in the Senate.

There was also a Bloomberg report Tuesday morning that highlighted an already known split within the White House about the border adjustment tax, a scheme under which exports are not taxed, but imports are. Border adjustment is designed to boost domestic manufacturing.

Trump has not taken a definitive stand on border adjustment, but reports say adviser Steve Bannon, Chief of Staff Reince Preibus, and Commerce Secretary Wilbur Ross all favor it, while Treasury Secretary Steven Mnuchin and National Economic Council director Gary Cohn oppose it.

"Markets want to see details," said Peter Boockvar, chief market analyst at the Lindsey Group. He pointed to a report from CNBC's John Harwood noting that there's not yet any White House replacement plan for Obamacare. That's despite that tax reform has been promised only after the Affordable Care Act is replaced, and Mnuchin has set an August deadline for tax reform.

In general, Treasury yields have been backsliding for several weeks.

"Every week we come in with a little bit lower yields, despite the fact you have these inter-week selloffs, only to find you have no details," said John Briggs, head of strategy at NatWest Markets.

Yields jumped in late trading after New York Fed President William Dudley was the latest Fed official to suggest the Fed sees a better case to raise rates. The 2-year was at 1.26 percent.

Stocks closed on the soft side ahead of Trump's speech. The Dow Tuesday broke a 12-day streak of record closes, after tying a 1987 run on Monday. The Dow slipped 25 to 20,812. The S&P 500 fell 6 points to 2363. Nasdaq was down 36 at 5825.

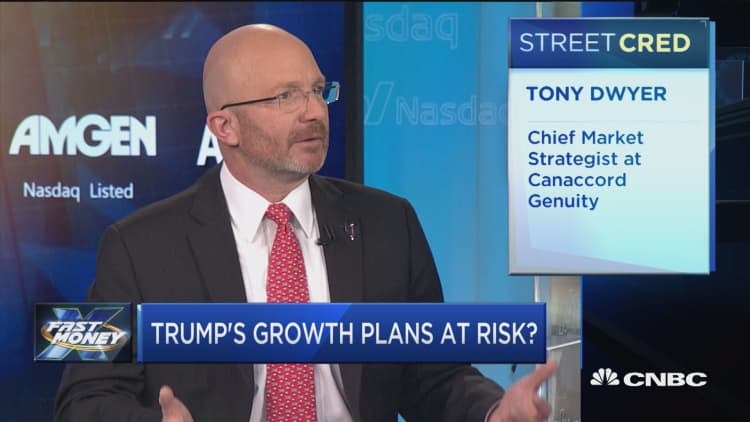

Watch: Trump growth plans at risk?