Pharmaceutical stocks fell out of favor after the election and suddenly caught fire again, leaving Jim Cramer to turn to the charts to determine if the pharma rally can continue.

To gain further insight from the charts, Cramer spoke with technician Bob Lang, founder of ExplosiveOptions.net and a colleague of Cramer's at RealMoney.com.

The pharmaceutical cohort was initially crushed last summer when investors heard about overly aggressive drug pricing, highlighted by Hillary Clinton. When Clinton lost the election, stocks began to rebound, but then President Donald Trump also said he wanted to crack down on the same practices, prompting them to fall again.

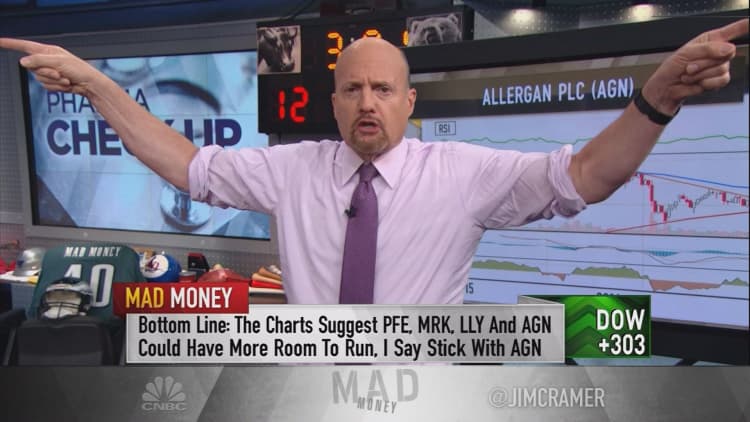

For five months this group was toxic, but then made a big turnaround in 2017. When Lang looked at the charts of Pfizer, Merck, Eli Lilly and Allergan, he discovered that the run could continue.

"This is great news for everyone who feels like they have missed the move, as none of these stocks are historically expensive and almost all can be bought right here, but leave some room in case this remarkable rally ever has a pullback," the "Mad Money" host said.

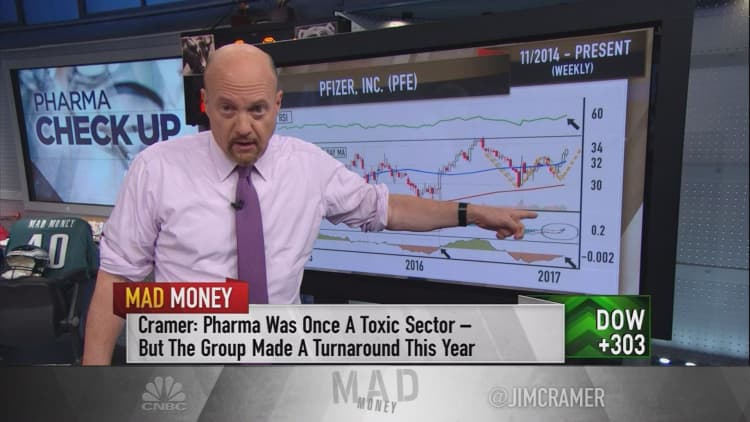

In fact, Lang thinks sleepy old Pfizer has the best chart of the bunch as the stock has made a series of higher highs and lower lows. The Chaikin Money Flow oscillator, which measures the amount of buying and selling pressure of a stock, is about to turn positive. According to Lang, the last time this happened, Pfizer rallied 20 percent.

Unlike the rest of the pharma cohort, Merck had a great year in 2016 and the rally has continued to 2017, with the stock up 12 percent this year. Looking at the weekly chart, Lang noted that this has been a relentless run on strong volume, but thinks it could go higher.

Eli Lilly has taken off since December, up 14 percent since the beginning of the year. And while investors could be late to the party with Eli Lilly, Lang pointed out that the moving average convergence divergence, or MACD, indicator made a bullish crossover at the beginning of the year.

"I feel like you might be chasing with this one, but Lang believes that Lilly's got more room to run," Cramer said.

Finally, the weekly chart of Allergan showed that the stock is finally gaining traction. The chart revealed to Lang a bullish "W" pattern. On top of that, Allergan broke its downtrend line last month, making both higher highs and higher lows as it rallied. Even the MACD indicator made a bullish crossover in late December.

Ultimately, Lang found that these four stocks could have more room to run, possibly even a lot more.

While Pfizer was Lang's favorite, Cramer chose Allergan based on the fundamentals as it is slated to roll out six potential blockbuster drugs this year.

Watch the full segment here:

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com