India shocked expectations on Tuesday by posting faster-than-expected economic growth in the December quarter, despite a move that drained cash from consumers during the period as the government swapped old currency notes for new.

But the country's former finance minister, P. Chidambaram, says it is too early to celebrate.

Official data showed India's gross domestic product (GDP) grew 7 percent annually for the quarter, sharply beating expectations for a 6.4 percent growth rate in a Reuters poll. The economy slowed from the September quarter's 7.3 percent annual growth rate.

"The GDP numbers have come as a bit of a surprise," Chidambaram told CNBC's "Street Signs" on Wednesday, adding that the 7 percent projection by India's Central Statistics Office is completely out of line with other projections he had seen, including estimates made by the IMF, the Reserve Bank of India (RBI) and the Center for Monitoring Indian Economy.

He said, "All these are very credible institutions which have made credible forecast in the past, so I think we'll have to take this number for what it is for the time being and examine it closely."

Prime Minister Narendra Modi announced on Nov. 8 that existing 500 and 1,000 rupee notes were banned, to be replaced with newly printed 500 and 2,000 rupee notes by the end of 2016. The unexpected move led to a massive shortage of notes in India's cash-heavy economy and experts predicted short-term disruption in logistics, production and supply of goods to affect sectors like automobiles, transportation, services and construction.

The better-than-expected GDP print also meant that the demonetization policy likely failed to tackle India's black money problem, for which it was introduced, said Schroders' emerging markets economist, Craig Botham. "For consumption to soldier on unaffected suggests that there has been little wealth shock."

The true impact on informal sectors

But there are expectations among other economists that India could end up revising its numbers lower for the December quarter since some of it does not add up with high frequency real activity data that provide more accurate snapshots of the economy. Monthly data on auto sales, purchasing managers' indexes, cement production and capital goods production in November and December showed notable declines, suggesting cash-intensive consumption and services were hit.

"The implications from the official GDP statistics that demand in the cash-intensive sectors (private consumption, transportation) picked up after demonetization appears to be at odds with the reality," according to Sonal Varma, chief India economist at Nomura. The standout figure in the GDP read was the 10.1 percent jump in private consumption — shown in official data compiled by Nomura in a note — in the quarter.

Citigroup economists Samiran Chakraborty and Anurag Jha said a combination of good monsoon rains crucial for farmers, wage hikes for public sector employees and festival demand were supportive for consumption demand. "But the sharp decline in our rural demand indicator indicate that this data point could be prone to revision in subsequent releases," they said.

A question many asked is how accurately did the quarterly GDP figures capture the impact of demonetization on India's sizable informal sectors, where much of the transactions happen in cash. Experts say the quarterly statistics use data on organized sectors as a proxy for India's unorganized sectors, implying the numbers may not accurately capture the effects.

Radhika Rao, an economist at Singapore's DBS Bank, told CNBC sub-trends suggested the formal sector might have benefited from the banknote ban, with more transactions taking place through electronic means.

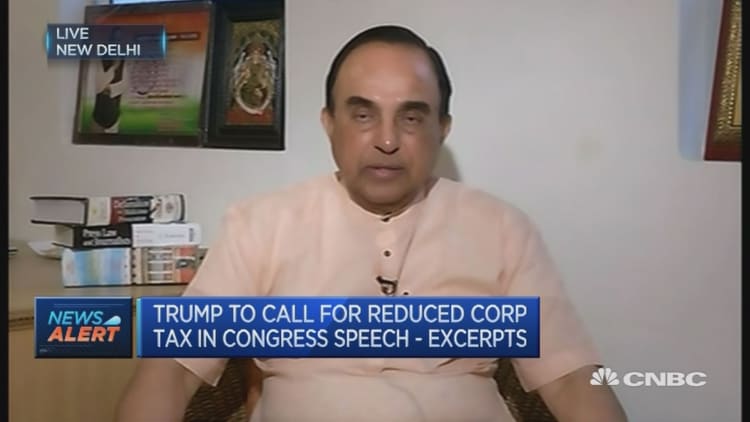

The ruling Bharatiya Janata Party's (BJP) member of parliament in the upper house, Subramanian Swamy told CNBC's "Squawk Box" that much of the calculations for the informal sectors were based on "guesswork," "benchmarks" and "ratios" as opposed to raw data.

"Therefore, I won't place too much emphasis on it. The real issues are the slowdown in small-and-medium industries because of the cash crunch," Swamy said, adding public-sector banks also needed huge recapitalization and the fiscal deficit was well beyond what the government budgeted for — issues, he said, the government needed to address. But he acknowledged that it was too early to tell if the demonetization shock on the economy is over.

Focus on the RBI

In its February policy statement, the RBI called the effects of demonetization "transient" and expected a rebound in consumer demand and restoration in economic activity by the closing months of fiscal 2016-17, which ends March 31. But the central bank changed its policy stance to neutral from accommodative, leaving itself room to either raise, hold or cut rates as necessary.

Under current RBI governor Urjit Patel, the RBI reduced the key repo rate by 25 basis points to 6.25 percent in October.

Swamy, who had been a vocal critic of former RBI governor Raghuram Rajan, said interest rates under the latter's tenure had risen too high and implied rates should be cut. "The rate of capital scarcity of the smaller-and-medium industries hit hard so we have to do something about that," he said.

Chidambaram pointed out the RBI's change in stance implied the central bank did not share the government's assessment of India's inflation outlook.

"If the government believes that inflation is well under control and the rates must be cut, why did the RBI say we're moving to a neutral stance?" he said.

The general consensus among analysts and economists remains that effects of demonetization on the economy have already began to ebb.

But some pointed out that the next big challenge India has weather through will be the impact of its Goods and Services Tax (GST) expected to be rolled out this year.