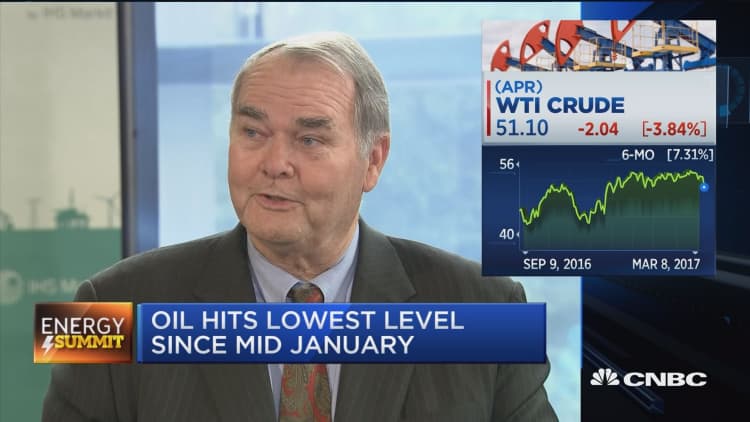

Oil prices slid about 2 percent on Thursday, extending the previous session's dive that brought prices to the lowest levels this year, as record U.S. crude inventories fed doubts about whether OPEC-led supply cuts would reduce a global glut.

U.S. crude prices fell through the $50 a barrel support level, with market participants unwinding some of the massive number of bullish wagers they had amassed after a deal by top global oil producers to limit output.

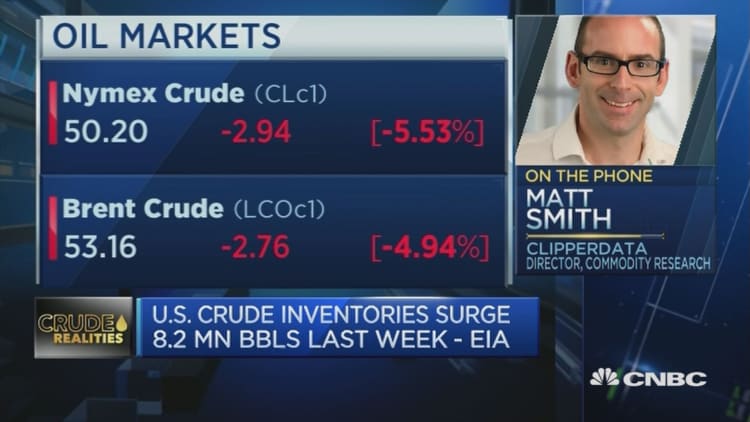

The losses followed Wednesday's slide of more than 5 percent, the steepest in a year, after data showed crude stocks in the United States, the world's top oil consumer, swelled by 8.2 million barrels last week to a record 528.4 million barrels, far surpassing forecasts for a 2 million barrel build.

"It was one month ago yesterday that the market got hit on a big increase in supply only to (have prices) rebound and start making new highs a few days later," said Phil Flynn, analyst at Price Futures Group in Chicago.

"The problem is this time, after an extended sideways period, a confirmation of a breakdown would suggest that this market will need some major news to get us back on that long term bullish track."

U.S. light crude settled down $1, or 2 percent, at $49.28, its weakest closing level since November 30. It was off a session low of $48.59, after plummeting 5.38 percent on Wednesday.

Brent crude oil was down $1.02 a barrel, or 1.9 percent, at $52.09 by 2:39 p.m. ET (1939 GMT), after reaching an intraday low of $51.50, its lowest since November 30. On Wednesday, Brent fell $2.81 a barrel, or 5 percent, in its biggest daily price move this year.

"The market went into a meltdown yesterday," said Tamas Varga, analyst at London brokerage PVM Oil Associates. "The risk is now tilted to the downside. Lower numbers are not a foregone conclusion yet, but bears are in control."

Still, options trade suggested hopes that prices would recover. The two most actively traded options in U.S. crude were the April $50 calls with more than 19,000 lots traded and the April $55 calls with more than 13,000 lots changing hands by early afternoon.

"Given that we do expect OECD oil stocks to decline substantially this year helped by the large OPEC cuts and robust global demand growth, we consider the recent drop in crude oil prices to be a good opportunity to enter into bullish option structures," strategists at Societe Generale said in a note.

The Organization of the Petroleum Exporting Countries and other exporters agreed in November to cut output almost 1.8 million barrels per day (bpd) in the first half of 2017.

But U.S. drilling has picked up, with producers planning to expand crude production in North Dakota, Oklahoma and other shale regions. The Permian, America's largest oilfield, has seen output jump.

This week, Saudi Oil Minister Khalid al-Falih said market fundamentals were improving but OPEC would not let rival producers take advantage of the cuts.

Kuwait's oil minister has said OPEC's compliance with cuts has exceeded targets.

Kuwait will host a meeting on March 26 of OPEC and non-OPEC ministers to review compliance with the production cuts.

OPEC hopes it can persuade other oil producers to make deeper cuts to try to push up prices that have been slumping for more than two years. So far the group has been tight-lipped about whether an extension was on the horizon.