Oil prices were largely steady on Friday, and looked set to finish the week with modest gains after losing almost 10 percent last week on concerns that an OPEC production cut was failing to reduce a global supply overhang.

Crude traded in a narrow band this week, with Brent and West Texas Intermediate bouncing in a $2.50 range as investors weighed the impact of the first oil cut from the Organization of the Petroleum Exporting Countries in eight years against rising U.S. shale oil output and high inventories.

However, oil has not been able to reclaim the range that prevailed through most of 2017 before last week's rout. Instead of rebounding to $53 a barrel, U.S. crude has remained stuck around $49. Analysts anticipate that regaining the old levels may be difficult without significant drawdown in inventories.

"I think that most are just reassessing the current state of direction. Everyone who was bulled up the past few months has turned," said Carl Larry, president of Oil Outlooks and Opinions in Houston.

The potential for increased U.S. production continues to build, as Baker Hughes weekly rig count data showed an increase of 14 drilling rigs in the United States.

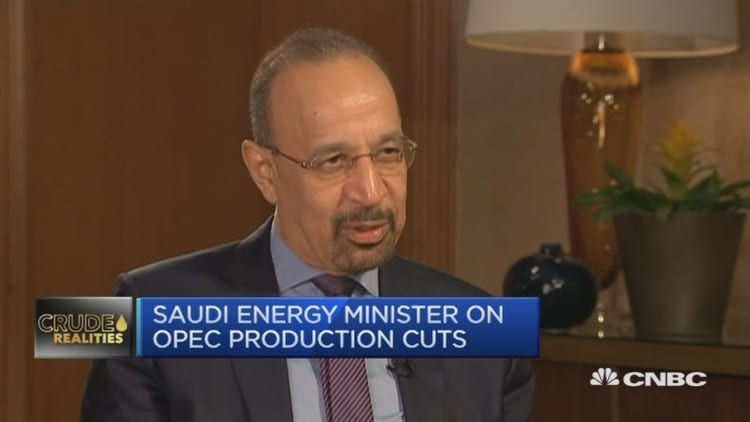

The market even failed to rebound after Saudi Arabia Minister Khalid al-Falih said on Thursday the cuts by the OPEC and non-OPEC producers could be extended beyond June if oil stockpiles stayed above long-term averages.

"Neither a weaker dollar nor Saudi talk of doing 'whatever it takes' to bring inventories down to healthier levels is inspiring much buying," said Timothy Evans, analyst at Citi Futures in New York, in a note Friday.

Evans noted that market sentiment may further weaken in the absence of a strong rebound to the previous range. Volume was low on Friday, with fewer than 125,000 futures contracts on CME changing hands by 1:15 p.m. EDT (1815 GMT), after the market's busiest stretch of the year last week.

Brent crude were up 3 cents at $51.77 per barrel, as of 3:34 p.m. ET (1934 GMT).

U.S. West Texas Intermediate crude (WTI) settled up 3 cents to $48.78 a barrel, ending the week's trading about 0.6 percent higher.

Six of 10 analysts polled by Reuters said they believed OPEC would prolong its output reductions past the deal's six-month duration.

Saudi Arabia has cut output by more than its share under the November 2016 deal. Some ask whether Riyadh has the appetite to continue while several OPEC and non-OPEC states fail to comply and as shale production is expected to rise.

The 11 non-OPEC oil producers delivered 64 percent of promised cuts in February, compared with 106 percent compliance from OPEC, an industry source said on Friday.

On Thursday, Falih told CNBC there is a learning curve to cutting production, and Riyadh wants exporters to accelerate their learning and "get on board fully."

OPEC and non-OPEC members agreed last year to cut output by a combined 1.8 million barrels per day (bpd) in the first half of 2017. But OPEC's monthly report showed global oil stocks rose in January to 278 million barrels above the five-year average.

Later Friday, the U.S. Commodity Futures Trading Commission releases calculations of net long and short positions in the crude futures market.

— CNBC's Tom DiChristopher contributed to this story.