The quarter started on a positive note as hopes for President Trump's pro-business agenda lifted markets to new records.

The , the Dow, and the Nasdaq all finished the quarter higher -- the S&P and Dow notched their sixth straight quarter of gains -- but that's not the whole story.

The so-called "Trump Rally" took a breather in March. The S&P and the Dow failed to set any intraday or all-time closing record highs, and both indices finished the month in the red, snapping four-month win streaks.

The market was focused on drama in D.C. as the Republican's highly anticipated repeal of the Affordable Care Act failed to get off the ground.

The financial sector suffered its worst performance since before the election as investors worried that Trump's failure to repeal Obamacare would be indicative of his inability to roll back parts of Dodd-Frank. (Ridding the banks of regulation is seen as a positive for the financial sector.)

The Nasdaq, while initially lagging the S&P and the Dow in the post-Trump rally, did finish the month in the green. It has now posted five straight months of gains, and is on its longest monthly winning streak since 2013.

Despite the slight pullback in March, the major averages remain near all-time highs. So, the question becomes what still looks attractive? What stocks still have room to run? And how is the market positioned to perform in Q2?

"Halftime Report" trader and Douglas C. Lane Managing Partner Sarat Sethi is waiting for earnings season -- which gets in full swing in two weeks -- to gauge the health of the economy.

In order for the market to move higher, Sethi believes companies will have to report growth in earnings. He notes that Emerging Markets and Europe are stabilizing, which is a good sign for the U.S. market since over 40% of S&P earnings come from overseas.

"Halftime Report" expert and TIAA Investments Equity Portfolio Manager Stephanie Link echoed Sethi's point.

"I think earnings will be better-than-expected...I think the market can continue to move higher, albeit very focused on sector allocation," she said over the phone. "Economic data points continue to point to owning more economically sensitive names rather than defensive names," she added.

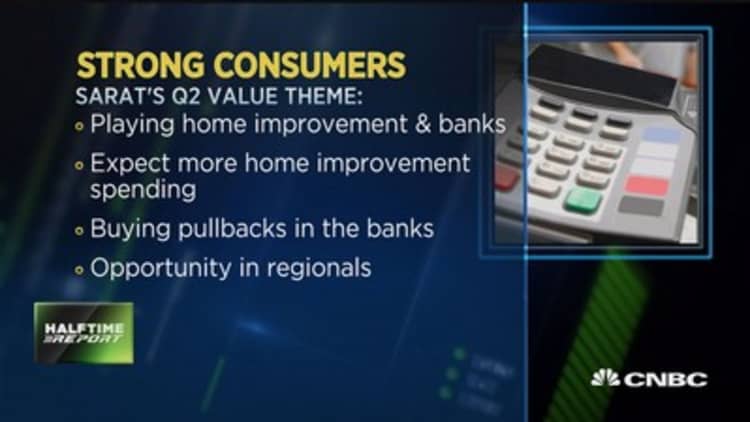

Sethi is looking to add to his positions in the financial sector. He believes it's a "long-term play" and that if "rates rise and the yield curve steepens, there's an opportunity to buy them."

Specifically, on the big bank side he's watching Morgan Stanley, Schwab, and JPMorgan. In regionals he likes BankUnited, BB&T, and U.S. Bancorp. In insurance he sees opportunity in Prudential and MetLife, and Synchrony is his credit card play.

Stephanie Link is also buying the bank trade -- specifically European banks. She watches for contrarian trades, and since investors are "still afraid of European banks," they fit the bill.

Also on Link's radar as a contrarian trade is the energy sector. "People have written off energy," she said. It's the worst-performing sector year-to-date, and she believes the "risk/reward" in the space is "interesting."

For Q2 Sethi is focused on the consumer, particularly after consumer confidence in March soared to its highest level since December 2000.

With this in mind, Sethi is watching housing-related stocks. A strong consumer means people will put money into their homes, so Sethi believes companies like , , and are positioned to move higher.

Since Link believes investors might start to gravitate more toward defensive names, she's also watching telecom. The sector has "massively underperformed," and she believes "there are pockets of places you can play." She adds that many names in the space have good balance sheets and pay a solid dividend.

On the flip side, going into Q2 Sethi is wary of consumer staples names that have "run fast and have high valuations."

Trader Disclousres:

Stephanie Link owns: AAPL, ABT, AGN, ALXN, AMZN, APC, APD, AVGO, AXP, BAC, BAX, BHI, CAG, CAT, CB, CI, CIEN, CMCSA, CMI, CRM, CSCO, CVX, CXO, DB, DOV, DOW, EL, EOG, ETFC, FB, FCX, GD, GOOG, GS, HDS, JPM, LLY, LRCX, MAT, MDLZ, MGM, MSFT, NKE, PANW, PF, PH, SLB, STI, T, TROW, UNH, UNP, URI, WBA, WFC, WLK, WMB, X, YUM, ZION

Sarat Sethi owns: AA, AAL, AAPL, AL, ACN, BWA, CERN, CSCO, DAL, DGI, DLPH, EXPE, F, FB, FBHS, GE, GM, GOOG, HAR, HON, IAC, ILMN, INTC, LB, M, MAS, MSFT, NVDA, PEP, PYPL, QCOM, SWK, SJM, TMO, UAL, V, WFM, XPO, YHOO, YUM, ZION. SARAT'S FIRM IS LONG AXP, BBT, BKU, FRC, JPM, LOW, MA, MET, PRU, SYF, USB, V