Jim Cramer knows the feeling of regret in investing all too well, and he has noticed it often comes hand in hand with discipline.

While discipline can help investors stay out of trouble when the market panics or corrects, it can also drive them away from opportunities that could have made them money.

"You have to be willing to say you missed it. [On Monday] when Panera Bread was screaming higher on takeover rumors, I got a tweet that said I should've ... held onto Panera for the charitable trust. No kidding," the "Mad Money" host said. "You think I didn't feel that way?"

The key thing to remember in situations like these is to manage your regret, which can mislead you in your next trade if you let it consume you.

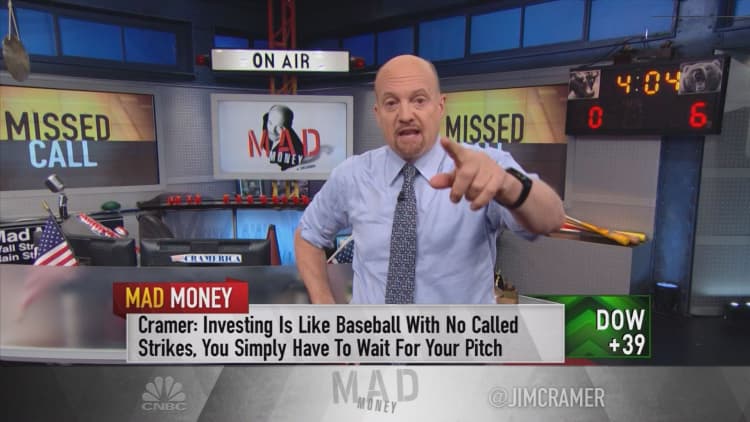

Watch the full segment here:

"Regret — it can be costly, but not in the way you think. Regret is costly becuase it blinds you to the next moment. Too busy, head's in the wrong place. Regret is costly when you let a losing stock run. Regret is costly when you're reckless and you put too much money to work at one level and then it drops again," Cramer said.

Instead of harping on not buying the right names at the right time or not waiting long enough to take profit, Cramer suggested dropping the "shoulda, coulda, wouldas" and thinking about where your portfolio is most vulnerable.

"Worry about losing money, not making money," he said. "You cut out the heavy losses and the winners take care of themselves."

Only sometimes can you win by disregarding discipline, but most of the time, it's a recipe for disaster, Cramer said.

"So you miss it. Big deal. You didn't expose yourself when you thought the market shouldn't be making a lot of headway. You didn't expose yourself when you thought, because of the season and the week and last week's mark-up, that the market should go down," Cramer said.

Don't get hung up on the "shoulda, coulda, wouldas." Sometimes, it's best to wait until the odds favor you.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com