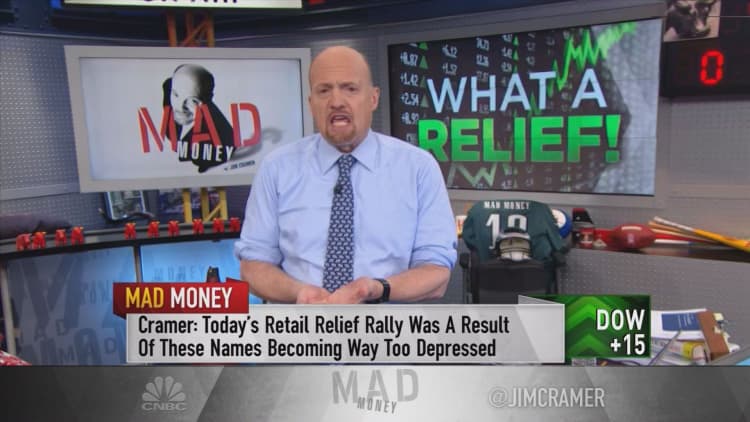

Traditional retailers are widely known to be struggling in the competition with e-commerce, and Jim Cramer said Thursday's "anti-Amazon" retail rally was not a consumer-driven comeback.

"[It] was a classic relief rally, where certain stocks just came down too far too fast, and then we got numbers that weren't quite as bad as people had feared," the "Mad Money" host said.

The stocks of brick-and-mortar players like Kohl's, Macy's, L Brands, Target, Bed Bath & Beyond, and Costco all skyrocketed as earnings reports indicated that the retail environment is not as bad as analysts anticipated.

"When you're as negative as most portfolio managers had become on retail, it really doesn't take much to get the group raging," Cramer said.

Watch the full segment here:

The negativity stemmed from hit after hit to the retail space that occurred in recent weeks, from Lululemon's over-20-percent drop to news of Urban Outfitters' slumping sales to Sears' going-concern letter.

Then on Wednesday, Citigroup's credit research branch released a note slapping a "sell" signal on all the retailers that Cramer called "a well-written obituary for bricks-and-mortar merchants."

Washington also played a role in the general pessimism as House Speaker Paul Ryan and other Republicans push for a border tax on imports to be included in tax reform, which would either raise costs on consumers or on retailers themselves.

But this week, retailers' fortunes seemingly looked up. In their earnings call, Bed Bath & Beyond executives did not slash their forecasts for the year and, in Cramer's words, "told a pretty compelling story."

Despite weak earnings numbers, L Brands, the Victoria's Secret parent, also was not negative in its forecast. Costco's 6 percent jump in comparable same-store sales overshot the Street's expectations of 3 percent.

"When you have all these retail obituaries written and then you get the actual proof of life, the sellers stop surfacing," Cramer said. "That's the kiss of death for short-sellers."

It is possible that in several days, the sellers could return, Cramer said. In his view, it is unlikely that traditional retail has bottomed.

But on Thursday, the bears' pessimism turned out to be overblown, and the obituaries, preemptive.

"Don't get too negative on any one particular group that still has a pulse, people, even if you think it's the walking dead," Cramer advised. "When too many investors get too pessimistic at once, it has a tendency to blow up in your face, just like we saw in today's session."

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com