Corporate debt hit new highs in 2016, even as earnings grew at a slower pace. The gradual increase in debt in recent years has attracted attention because the ratio of debt to corporate earnings usually peaks during economic downturns, not during economic expansions.

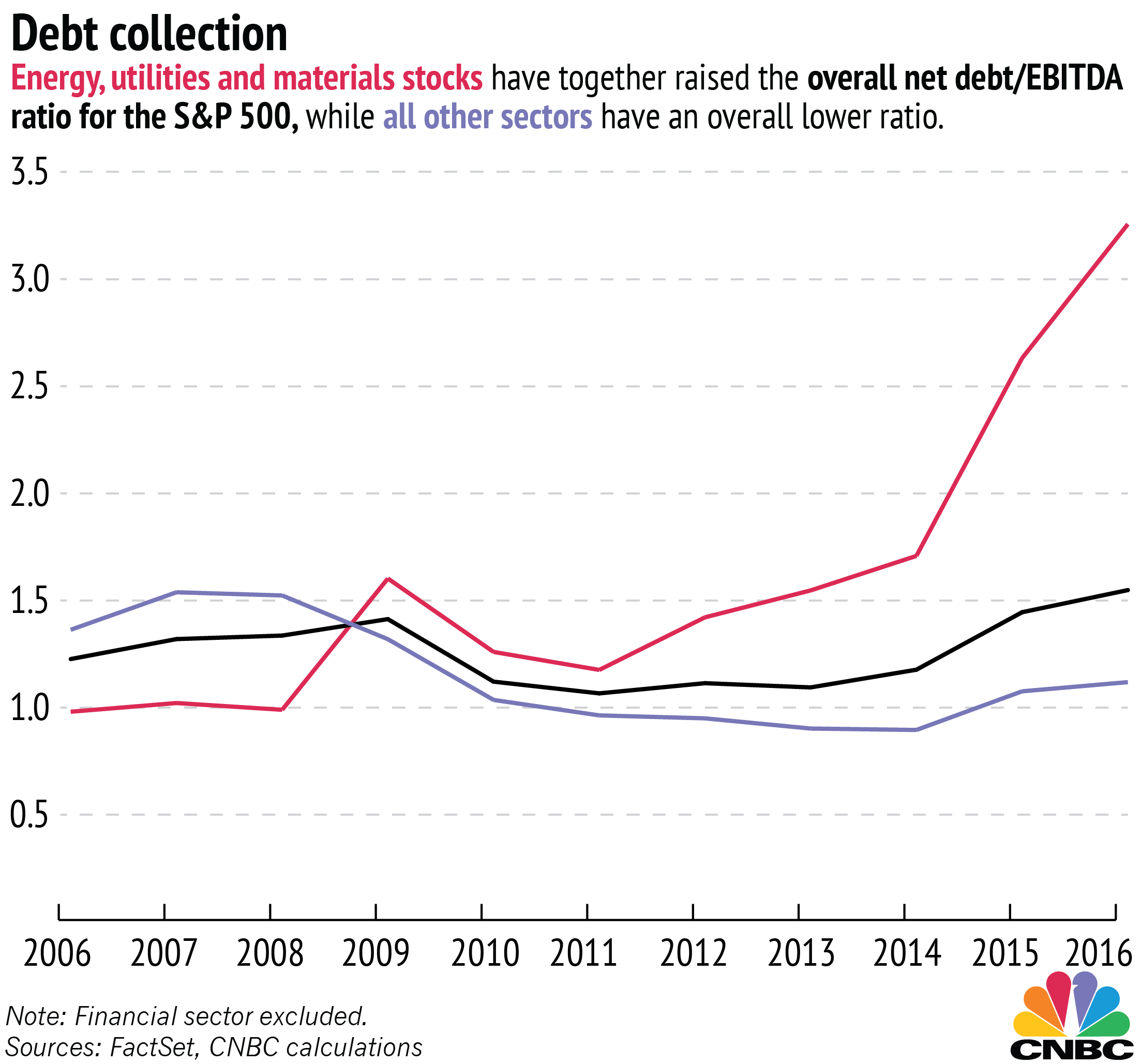

That imbalance, which has led some investors to worry about the health of the market, is not spread evenly across all companies. Much of the debt accumulation relative to earnings has taken place in a few industries, according to an analysis by CNBC.

Over the last decade, total annual EBITDA for the S&P 500 as a whole rose and then flattened, while debt issuance has continued to take off in recent years. That means that the net debt over EBITDA ratio, or how many years it would take to pay off that corporate debt, has been driven up.