Wells Fargo's recent report regarding its fake account scandal did little to assuage investors nervous over what the long-term ramifications might be.

Shares of the third-largest U.S. bank by assets are down more than 2 percent this week as part of a broader sell-off in financials. However, there are specific issues with Wells that could cause even more obstacles.

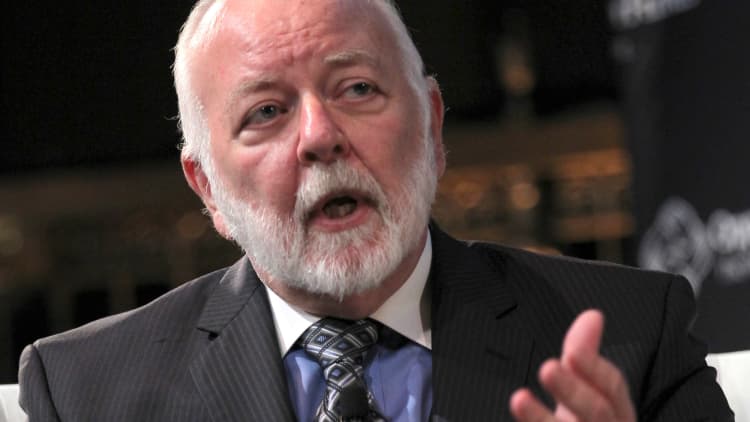

That's why Dick Bove thinks investors ought to dump the stock, at least for now.

In a note to clients, the vice president of equity research at Rafferty Capital Markets and closely watched bank analyst reinstituted the sell rating he had on Wells Fargo. Bove had put a sell on the bank when the controversy first erupted in September, but then lifted it to hold as Wells looked to put the scandal behind it.

However, news this week that the bank had clawed back $75 million from former CEO John Stumpf and Carrie Tolstedt, who ran the community bank division, set off another round of questions. The clawback revelations came in a report the bank board commissioned into what happened in a scandal that saw Wells Fargo workers set up some 2 million accounts for customers without their knowledge in an effort to meet aggressive sales goals.

Bove said the move to centralize operations is actually a positive, but one that will take time for a culture "built on ignoring directives and lying."

"Confrontations between the corporate office and the divisional offices are highly likely," he wrote. "Departures by top sales people are quite likely as they move to less restrictive operating environments where they can make more money."

Moreover, regulators poring over the report "are likely to be appalled" both at the bank's behavior and the way their predecessors failed to catch what was happening in sales practices that stretched over a 15-year period.

The immediate impact seen on Wells Fargo will be that sales will be scaled back while the company makes necessary changes. While positive over the long run, it will take time for the bank to adapt, Bove said.

"The biggest battle ahead is whether this company can be effectively managed," he wrote. "The stock should be sold until that question is answered."

To be sure, Bove's sentiments about the bank are not universal.

Analyst Scott Siefers of Sandler O'Neill told CNBC that "the worst is over" for the stock as investors probably have priced in all the bad news. Analysts at Keefe, Bruyette & Woods, meanwhile, last week raised their price target from $53 to $63 — about a 19 percent jump from the current level — and boosted the rating to outperform. However, the KBW move came before the board's report was released.

Wells Fargo shares have tumbled more than 9 percent over the past month, are down more than 3 percent year to date and were among the sector's worst performers Wednesday, dropping 1.4 percent in morning trading.

Bank stocks in general have been taking a beating after bursting higher after the November presidential election.

Earnings season begins this week with major banks reporting Thursday. Wells Fargo is projected to post a profit of 97 cents a share — 2 cents lower than the same period in 2016 — on revenue of $22.3 billion, according to Thomson Reuters estimates.

WATCH: Wells Fargo CEO Tim Sloan explains what happens now with the troubled bank.