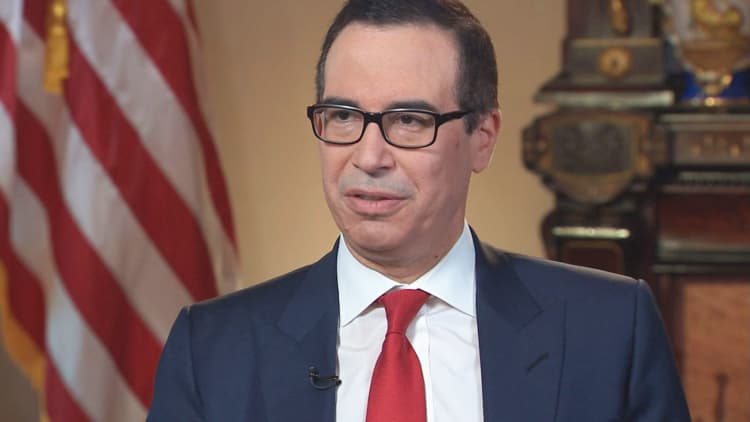

US Treasury secretary Steven Mnuchin triggered a brawl over protectionism during his first overseas meeting last month when he blocked fellow G20 finance ministers from issuing a longstanding exhortation against erecting trade barriers. At his second international outing he seems intent on steering the discussion on to less slippery terrain.

In an interview with the Financial Times ahead of this week's spring meetings of the International Monetary Fund and World Bank, the former Goldman Sachs banker sought to assuage fears that US President Donald Trump was about to rip up the global economic order or launch a new round of currency and trade wars.

More from the Financial Times:

Trump signs 'Buy American, Hire American' order

US Treasury canvasses appetite for 'ultra-long' bonds

Support builds for watered-down Glass-Steagall law

Instead, he laid out an agenda that gives credence to the growing view in Washington that, when it comes to economic policy at least, the Trump administration may be turning out to be a variant of mainstream Republicanism rather than the fire-breathing "America First" populism Mr Trump employed to get elected.

Mr Trump campaigned on the promise to name China as a currency manipulator on his first day in office. But Mr Mnuchin presented the administration's decision not to do so as a simple acknowledgment that Beijing is, if anything, now propping up its currency rather than weakening it for economic advantage.

"To manipulate a currency you have to be doing it to disadvantage the United States. To the extent that you manipulate a currency that advantages the United States that is not currency manipulation," he said.

He also rejected the idea that recent complaints by Mr Trump about the strength of the dollar were an attempt to talk down the US currency. "Absolutely not. Absolutely not," he said.

The US remains concerned about currency issues, Mr Mnuchin made clear. The Treasury's twice-yearly currency report may have reached the same conclusion as previous findings but "the details" and the tougher criticism of China were different, he said. The Trump administration also expected the IMF to be more vigilant about global currency swings, with Mr Mnuchin arguing that addressing the issue was "one of the IMF's most important roles".

If some feared Mr Trump's election might signal US withdrawal from the world, Mr Mnuchin offered signs of the administration's willingness to engage in attempts to deal with economic crises elsewhere.

While he stressed that the IMF's primary role was not to lend to rich countries, the Treasury secretary's words did not suggest he was planning to impose obstacles on possible IMF participation in Greece's €86bn bailout.

At present, the fund and Athens' European creditors are in a race against time to broker a deal that would bring the IMF fully on board in the aid programme.

The US was continuing to encourage the IMF to discuss its participation, Mr Mnuchin said.

"We think this is primarily a European issue, although it is something we are monitoring because it is important to the world economy and world financial markets," he said, adding that he was hopeful a resolution to the "Greece situation" would come in the "near future".

He had also been impressed in his first meetings at the World Bank last week, especially with its private sector-focused International Finance Corporation division, although he said it was too early to say whether the US would back the idea of a capital increase. Some other stakeholders see such a move as necessary if the bank is to keep up its current level of lending.

Among the issues high on the agenda at this week's IMF meetings in Washington is the fear in some circles that a post-crisis international consensus on the need for stricter financial regulation may be dissolving.

To manipulate a currency you have to be doing it to disadvantage the US. To the extent that you manipulate a currency that advantages the US, that is not currency manipulationSteven Mnuchin

Mr Mnuchin did not set out a slash-and-burn approach to regulation, stressing his desire to use existing forums such as the US Financial Stability Oversight Council, a powerful group of US regulators, to further the Trump administration's agenda, and to think beyond legislative change.

He said he wanted to use his role chairing FSOC — which includes the Treasury department, the Federal Reserve and the Securities and Exchange Commission — to bring America's financial regulators together and better co-ordinate their efforts.

Among the issues being examined was the Volcker rule, which prevents banks from engaging in proprietary trading, Mr Mnuchin said. He said aspects in the definition of the rule were limiting liquidity in secondary markets.

One of the difficulties in adjusting the Volcker rule is that it has been overseen by a number of different agencies, and Mr Mnuchin said he wanted to use his position at FSOC to ensure that could be overcome.

Amid an intensifying debate over the merits of revisiting a regime dismantled in the 1990s, Mr Mnuchin said he and Mr Trump supported a 21st century version of Glass-Steagall — the legislation that once split commercial from investment banking — rather than a renewal of the old law.

Banks and investment banks have changed "dramatically" since that time, he explained, signalling that one future option involved ringfencing investment functions within banking groups. "A full separation would clearly create very big issues for liquidity in the financial markets," he said.

Coverage of Mr Mnuchin's first international foray, at G20 meetings in March, was dominated by headlines over the administration's attitude to trade.

The communiqué following meetings in Baden-Baden, Germany, omitted tough language vowing to resist all forms of protectionism after a stand-off between the US and its partners. The discarding of what were previously uncontroversial statements on trade was taken as a sign of the anti-globalisation mood that Mr Trump had brought to Washington.

But Mr Mnuchin insisted that trade had not been the focus of those meetings, even if it accounted for "80 per cent of the press". He highlighted terrorist financing and cyber security among key topics for discussion with foreign partners this week as well as new sanctions the administration is planning against Syria, Iran and North Korea.

"I don't expect this just to be repeat of previous issues," he said.