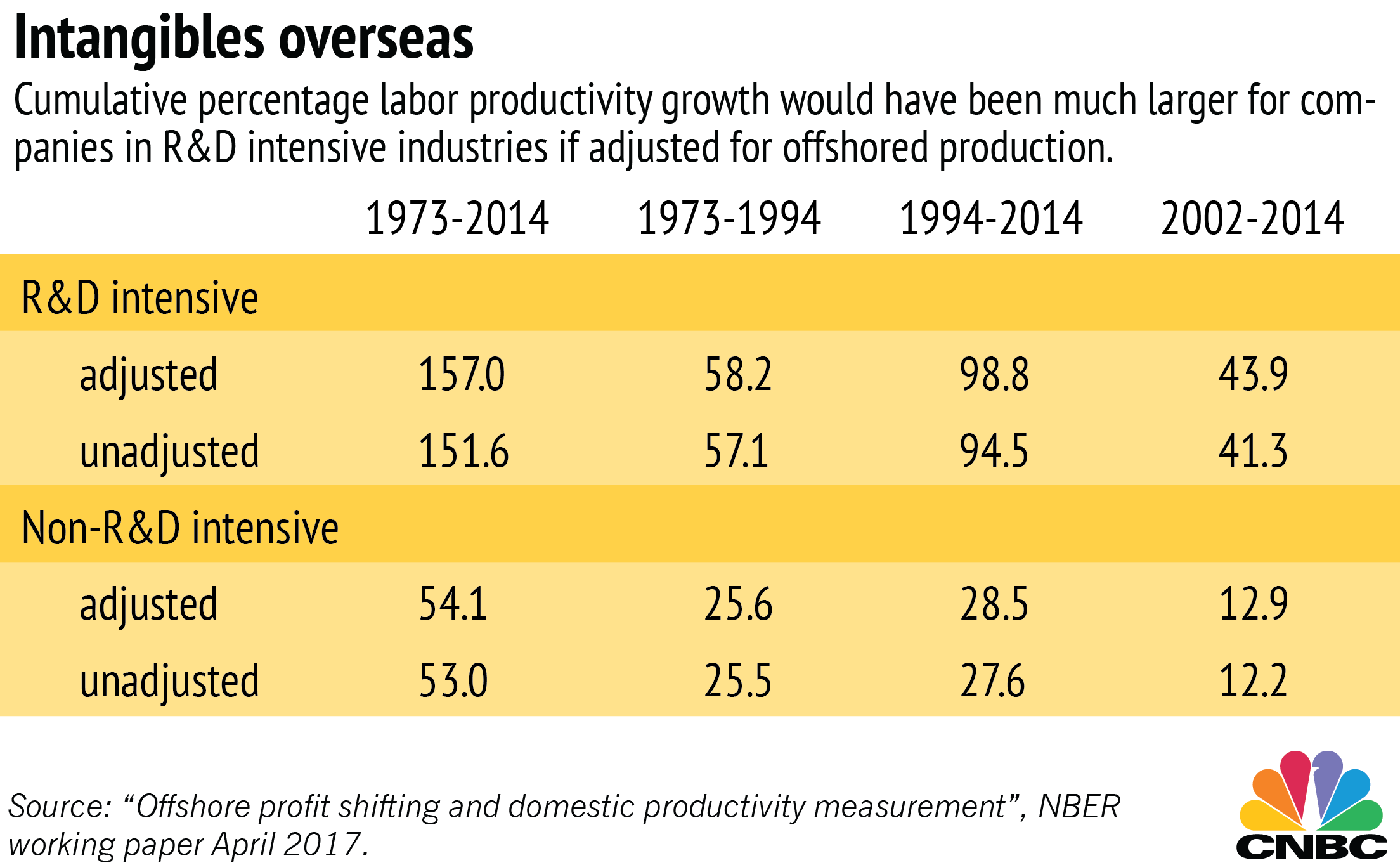

Where did America's productivity growth go? Some of the missing gains can be found overseas, along with the diverted profits of U.S. corporations, according to recent research.

American companies have become adept at stashing their earnings in foreign countries. Legal tax avoidance practices have not only allowed companies to shortchange the IRS, but they have also depressed official labor productivity growth statistics, according to a National Bureau of Economic Research working paper.

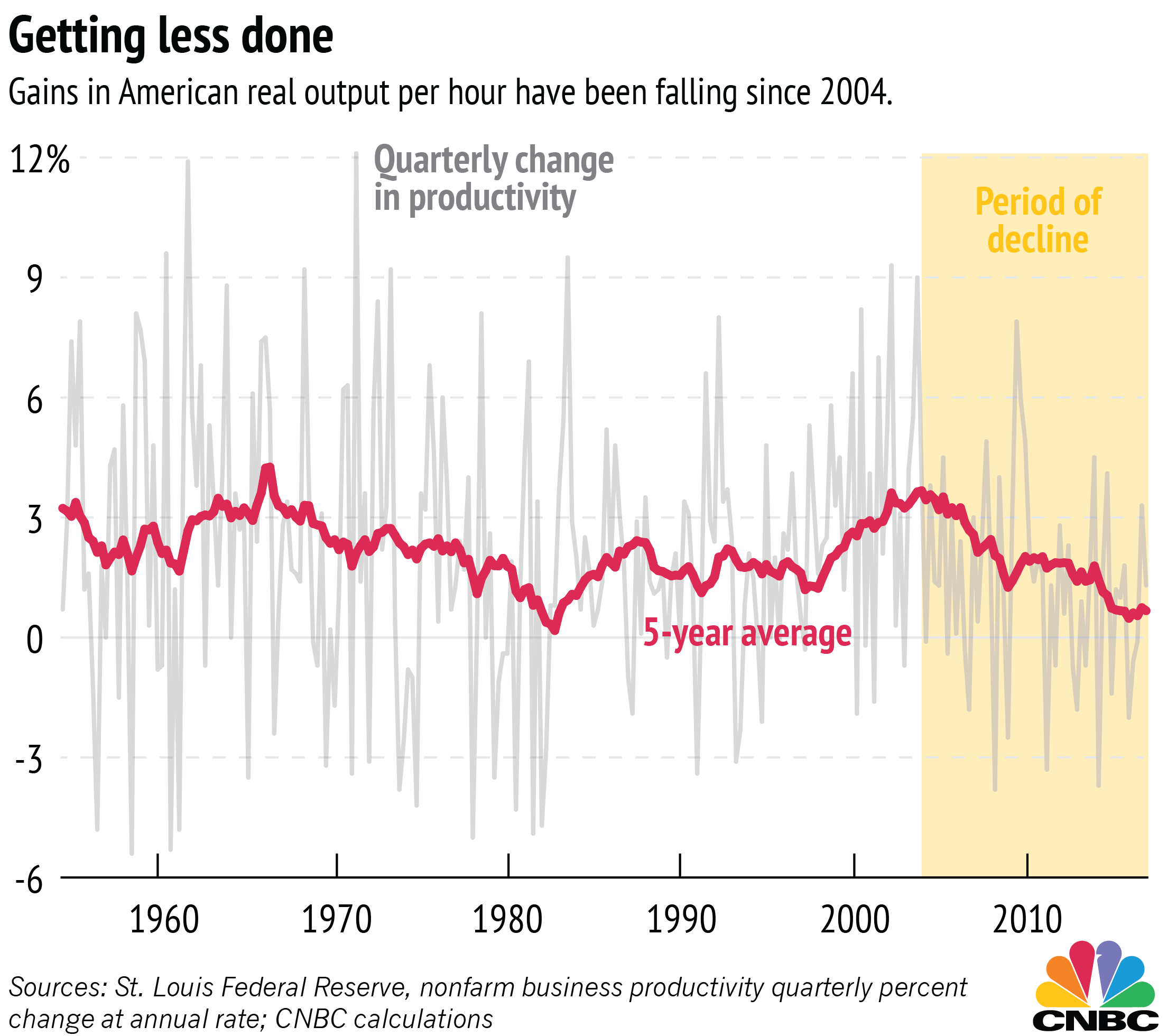

That lost economic output has cut almost 0.1 percent each year from productivity growth rates — a small but not insignificant change for rates averaging less than 2 percent a year.

"The current international accounting system allows a lot of flexibility — you might say too much flexibility — which allows companies to shift their profits to low-tax jurisdictions," said Fatih Guvenen of the University of Minnesota, one of four authors on the working paper. "A lot has been written about that in the context of taxation, but the same problem also matters for how we measure GDP in official statistics."

The study is another piece of evidence to help explain one of the biggest economic mysteries of our time: Why do official figures show slowing productivity growth when innovation by U.S. firms seems as strong as ever? Profit shifting has ramped up over the last two decades, the same period over which productivity growth has declined.