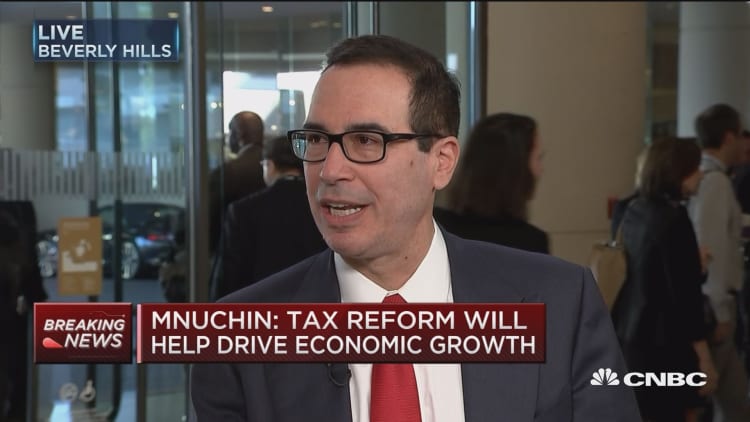

President Donald Trump's tax-cutting plan aims to eliminate all loopholes except the mortgage interest and charitable giving deductions, Treasury Secretary Steven Mnuchin told CNBC on Monday.

He reiterated that the White House wants to provide relief for middle-income earners, not the rich.

On "Squawk Alley," he called it the "Mnuchin Principle" — the idea that getting rid of deductions and lowering tax rates would benefit working Americans, while not necessarily reducing the effective tax bills for the wealthy.

In a CNBC interview in November, the then-Treasury secretary nominee surprised Wall Street by saying, "there will be no absolute tax cut for the upper class" because cuts will be offset by closing loopholes that help the rich. Mnuchin told CNBC Monday he stands by those comments, which he lightheartedly said were brought up during his confirmation hearings.

He said the reason the White House did not put more details into last week's tax blueprint is because the president wants to work with Congress on getting it done. On the corporate side, he called the U.S. tax system for businesses the "most" noncompetitive in the world.

Reacting to criticism over a lack of specifics in the president's tax ideas, White House budget director Mick Mulvaney told CNBC last week that the plan was purposely vague. "We did it on purpose. Not to try and hide the numbers, but to say, 'Look, this is the first discussion,'" he said.

Another concern about the White House's tax approach is whether it will be revenue-neutral. Vice President Mike Pence told NBC's "Meet the Press" on Sunday the proposal could increase the deficit, "maybe in the short term."

Meanwhile, Trump told CBS in an interview that aired on Sunday that he's going to pay for his tax cuts by increasing economic growth and making better trade deals.

On Monday, Mnuchin also argued that Trump's policy agenda of tax cuts, infrastructure spending and deregulation would lead to "sustained 3 percent economic growth or higher." He was responding to former Federal Reserve Chairman Ben Bernanke's comments earlier Monday on "Squawk Box" that the economy is unlikely to break above 3 percent.

On stage Monday at the Milken Conference, Mnuchin said it will probably take two years to get to 3 percent growth.

The government on Friday reported the weakest pace of economic growth in three years in the first quarter. Gross domestic product increased at a 0.7 percent annual rate. The economy grew at a 2.1 percent pace in the fourth quarter.

A CNBC review of decades of GDP data shows first-quarter growth has been routinely understated.

The economy grew 1.6 percent for all of 2016, its worst performance since 2011, after expanding 2.6 percent in 2015.

— Reuters contributed to this report.

Watch: Mnuchin breaks down Trump's tax plan