The merger of consumer-review site Angie's List and IAC's HomeAdvisor has huge potential and may be just the beginning of IAC's expansion into the space, CEO Joey Levin told CNBC on Tuesday.

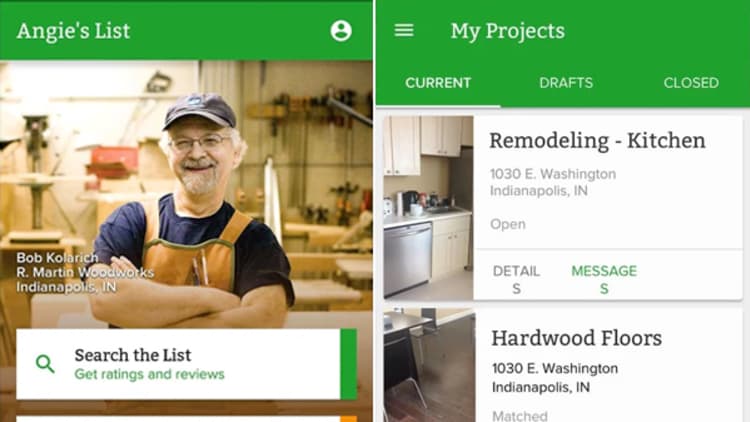

The company announced the deal on Monday. The new publicly traded company will be called ANGI Homeservices Inc.

It happened about a year and a half after Angie's List rebuffed IAC's first bid. About six months ago, Angie's List reached out to IAC, Levin said.

"We started to dig in very deeply. And when we dug in, we realized the potential for our business with their business ... was enormous," he said in an interview with "Closing Bell."

He hopes to use the same strategy IAC has used in its other businesses to expand its footprint.

"You look at travel and there's been enormous roll-up in the travel category under Expedia. You look at Match, and there's been enormous roll-up in the dating category. I'd love to see the same playbook work out here in HomeAdvisor," he said. "Right now we're ... focused on just one, and I think it's a big one to digest, but that could be the playbook in the future, I hope."

IAC will own a "significant" portion of ANGI Homeservices, 87 percent to 90 percent, Levin explained.

Shares of Angie's List soared Tuesday, closing up over 61 percent. IAC ended the day 14 percent higher.

Levin said the big boost in Angie's List reflects a number of things, including the value of Angie's List, the value of HomeAdvisor and the value of the synergies.

In fact, he said, HomeAdvisor has been on "an unbelievable run" recently.

"They've been growing revenue and top line for … seven or eight straight quarters, over 35 percent. The business is in a very good place right now. So I think that's a piece of it, too. People are excited about getting a piece of HomeAdvisor," Levin said.

And there will likely be more acquisitions to come for IAC after everyone catches their breath, he said.

"We always look for new opportunities," Levin said. "What's left in IAC, in addition to a handful of very interesting businesses besides both Match and ANGI Homeservices, which will be public, is a significant pile of cash, and we'll look to deploy that aggressively as we always do."