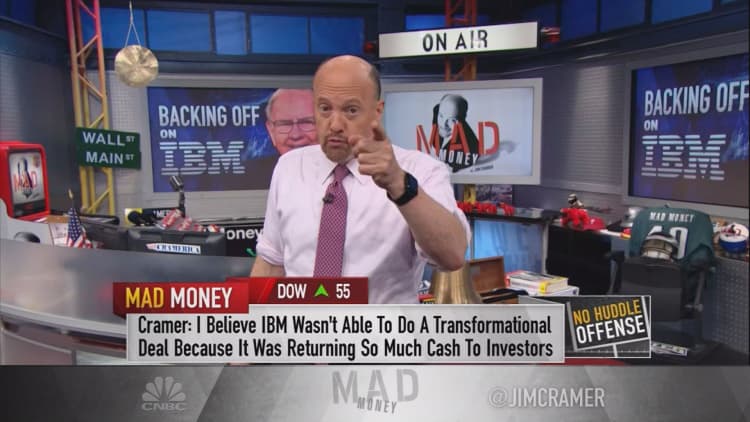

Warren Buffett selling a third of his stake in IBM had Wall Streeters reeling over whether to buy or sell their shares of the tech giant, and Jim Cramer had one thing to say to those investors.

"Let me ask you a question first. Did you buy IBM because the Oracle of Omaha owned it? If so, sure, leave the building and don't let the door hit you on the way out because you should be ashamed," the "Mad Money" host said. "If you bought it because of him, you never knew what you owned anyway so you might as well be a lemming and blow the darned thing out."

That being said, Cramer understood the legendary investor's disappointment with the company. IBM has now seen 20 quarters of decreasing revenue and years of fierce, up-and-coming competition.

"He wasn't sold on the strategy because the strategy wasn't paying off," Cramer said.

Watch the full segment here:

Cramer himself was not impressed with the company until two quarters ago, when IBM finally started to see considerable growth in what the "Mad Money" host considered to be its most promising areas: analytics and cognitive intelligence like Watson.

But IBM's weakness in its legacy businesses overshadowed the improvements, putting yet another negative shadow on the company's prospects.

With Buffett scaling back his holdings, IBM is at a critical moment. Cramer said he always felt that CEO Ginny Rommety felt she had time to spur change with Buffett behind her, but now, she and her management team are less protected.

"More important, though, I'm hoping that she and her team feel liberated," Cramer said. "They've returned so much cash to shareholders through dividends and buybacks that they haven't been able to do the kind of transformational acquisition, the buy of an Adobe, or a Salesforce or a Workday, or even a Twitter — something so cloud-based that it would change the company's complexion overnight."

Cramer argued that Buffett stepping back will give the company more freedom to explore these options and forge a path to new investments coming in.

And if Adobe, Salesforce, and Workday are too large for IBM to buy, Cramer finds Twitter to still be a viable and possibly beneficial play.

"[IBM] could buy Twitter to take advantage of all of its ability to keep track of the feedback for its customers while using the exquisite direct message function to stay in touch with those clients. It would become a company that, in one fell swoop, would suddenly be a lot more social, mobile and cloud," Cramer said.

If IBM were to merge its artificial intelligence play Watson with Twitter's platform, it could mean volumes for IBM's clients in the area of analytics as well, he said.

While Cramer doubts IBM will take his advice, he insisted that it could be a risk worth taking for the company after Buffett's very public partial withdrawal.

"The current course isn't working when it comes to the stock or the flag planted in cognitive and analytics," Cramer said. "Buying Twitter would be just the move it needs to do to say, 'Look at us, we have the knowledge, the smarts, and we can integrate this raw platform into the new IBM, not the old one that serially bought back stock and paid a big dividend.'"

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com