Chamath Palihapitiya,

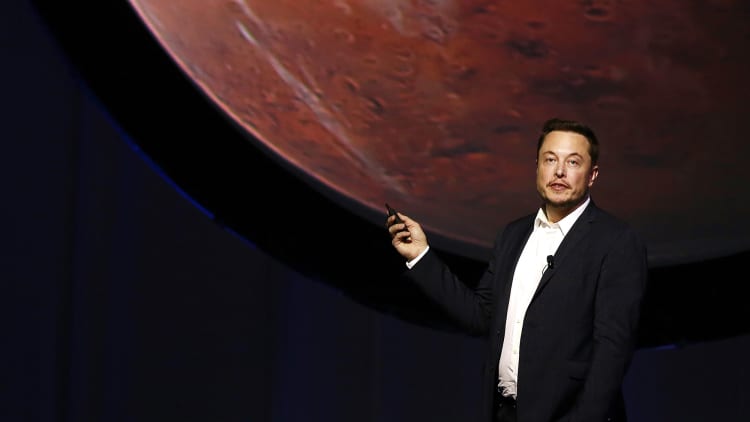

"The Tesla convertible bonds give us a way to stand shoulder to shoulder with a guy who we think is our generation's Thomas Edison," he said. Tesla could be "worth hundreds of billions in a decade." The specific convertible bonds he said he was buying had a 2022 maturity.

The idea from the former senior member of the investment team at Facebook was presented at the Sohn Investment Conference in New York.

"Early traction of Tesla is tracking very closely to Apple," Palihapitiya said. "They are expanding into adjacent markets."

The investor cited how the company is expanding to autonomous driving technology, electric

Palihapitiya predicts Tesla will be

Tesla shares turned positive shortly after the hedge fund manager mentioned the company on stage.

It may get a little awkward in the halls of the Sohn conference this year as David Einhorn, slated to speak after Palihapitiya later Monday, said last week that the valuation for Elon Musk's electric vehicle company is "reminiscent of the March 2000 dotcom bubble."

Palihapitiya pitched Amazon stock at the previous year's Sohn conference, which is up about 40 percent during the last 12-months.

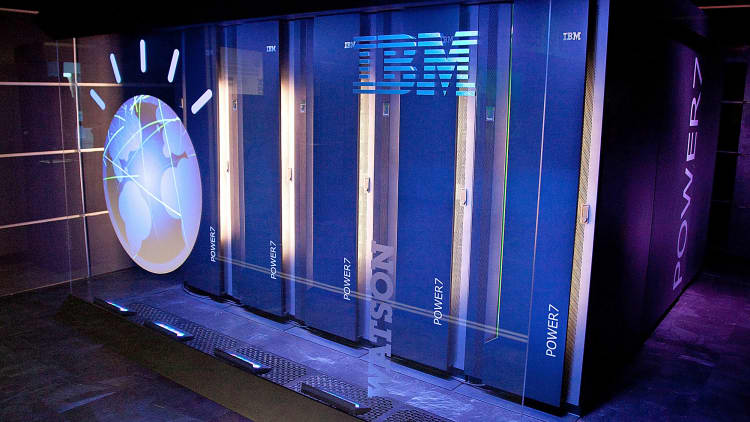

Watch: IBM's Watson is a joke