Pandora is actively trying to sell itself and believes it can get a deal done within 30 days, sources familiar with the company's thinking told CNBC.

KKR — an investment firm known for its private equity and hedge funds — said Monday it plans to invest $150 million in Pandora in exchange for new shares of preferred stock, a deal that will close in 30 days.

Sources said Pandora thinks the KKR investment makes a sale more likely to happen. A Pandora spokesperson declined to comment.

If Pandora sells itself within that 30 days, it would have to pay KKR $15 million. But sources said the company views that money as an insurance policy of sorts that effectively gives the company a 30-day option to sell itself — which it thinks it can do.

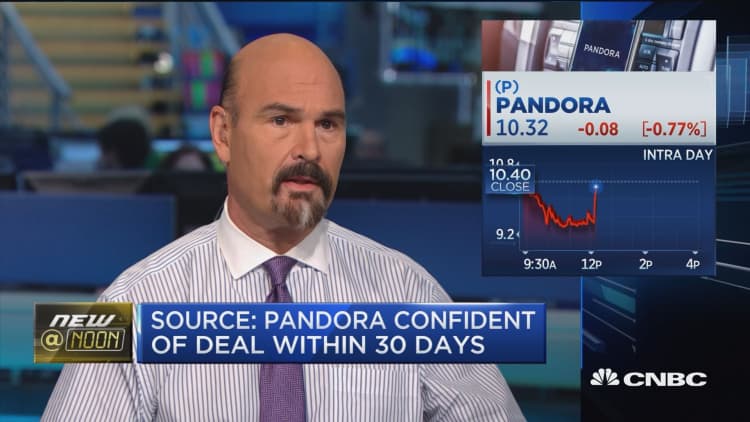

Pandora shares were lower on Tuesday before the report, after a slew of news dropped on Monday related to the deal, including mixed financial results, and an announcement that two board members would resign. Shares pared losses slightly after news that Pandora is actively working to close a deal.

KKR's Richard Sarnoff will also join Pandora's board — but two other directors will leave. Venture capitalist James M. P. Feuille and technology investor Peter Gotcher will resign from Pandora's board, and a committee will appoint new directors, Pandora said.

"Having secured a significant financial commitment from KKR to strengthen the Company's balance sheet, we have positioned the Company to evaluate any potential strategic alternatives, including a sale, in the 30 days before the financing is set to close," outgoing director Feuille said in a statement.

Pandora earned more per share than Wall Street expected in the first quarter of this year, but it lost listeners from a year ago. And a new strategy around premium subscriptions wasn't able to boost forward guidance to meet estimates.

With more competition than ever, the streaming company has faced challenges turning a profit. , a hedge fund run by Keith Meister, had previously pushed Pandora to sell some of its assets, while SiriusXM has been suggested separately as .

Still, Pandora remains a popular business. It's been the No. 1 grossing music app every day in the App Store for the past six months with the exception of 5 straight days in November when Spotify took over, according to research from Apptopia.

— Reporting by CNBC's Scott Wapner on "Fast Money: Halftime Report." Written by CNBC's Anita Balakrishnan. David Faber and Jason Gewirtz also contributed to this report.