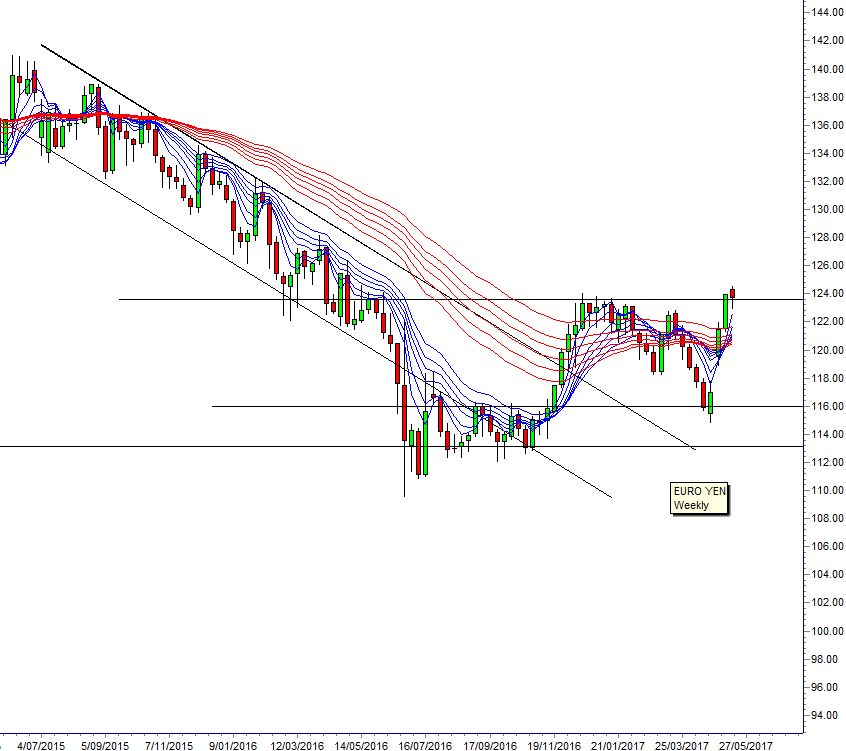

The channel pattern is important because it defined the price activity for 18 months. It shows the euro/yen has a strong tendency to move in a trading channel so traders are alert for the future development of an up-sloping trading channel.

The support trading band is more important for the current development. This support band is between 113 and 116. The rally rebound has developed from the upper edge of the support trading band near 116.

The distance is measured from the upper edge of the support band and the upper edge of the resistance level near 123.5. The value 7.5 is projected upwards above 123.5 and gives an upside target near 131.

This pattern target level is a little below the long term historical resistance level near 132 so this suggests the breakout above 123.5 can reach as high as 132.

Support developed near 127.5 in 2015 March. This level acted as a short-term resistance level in 2016 March. The rally move to the pattern target near 132 has to pass through the minor support and resistance level near 127.5 so traders will watch for consolidation behavior near this area.

The potential for the euro/yen to reach the 131 chart pattern projection target is confirmed by the Guppy Multiple Moving Average indicator. This is applied to the weekly chart. The long-term group fob averages has compressed and is beginning to turn upwards.

This behavior is usually associated with a long term sustainable change in the trend. The short term group of averages have also moved above the long term group of moving averages. This is a bullish relationship and confirms the high probability of a sustainable trend change.

Investors watch for consolidation around 123.5 and they prepare for a continuation of the breakout towards 123.5 with a longer term upside target between 131 and 132.

We use the ANTSYSS trade method to extract good returns from these long-term movements.

Daryl Guppy is a trader and author of Trend Trading, The 36 Strategies of the Chinese for Financial Traders, which can be found at www.guppytraders.com. He is a regular guest on CNBC Asia Squawk Box. He is a speaker at trading conferences in China, Asia, Australia and Europe. He is a special consultant to AxiCorp.

For more insight from CNBC contributors, follow

@CNBCopinion

on Twitter.