With companies sending mixed signals about the state of the economy and a White House in the midst of political turmoil, Jim Cramer knows it is hard to tell where you stand in this market.

"Which is why, going into the Federal Reserve's June meeting, we're going to have to start hanging on every word from the presidents and governors of that august body. Yep, you need to start paying attention to the Fed heads again," the "Mad Money" host said.

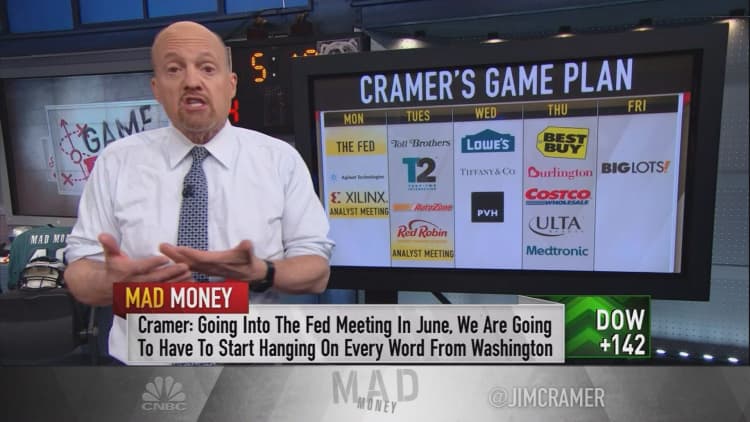

With the Fed's interest rate agenda in mind, here are the stocks and events on Cramer's radar next week:

Monday: Fed speakers, Agilent, Xilinx

Fed: Minneapolis Fed President Neel Kashkari, a known dove, will speak to his vision of the economy. Cramer expects it to be cautious, but noted that the more hawkish Philadelphia Fed President Patrick Harker will also speak and is likely to express a more positive outlook.

"Will they cancel each other out?" Cramer wondered. "Who knows. All I can say for sure is their utterances will dominate the action next week now that the earnings season is indeed winding down."

Agilent: This Cramer-fave life sciences and chemical machines company will report second quarter earnings, and the "Mad Money" host thinks that if the numbers are worse than expected, it could attract a corporate buyer.

Xilinx: An analyst meeting at this semiconductor and programmable logic devices manufacturer could signal that despite takeover rumors, the company is not looking for an acquirer.

Tuesday: Toll Brothers, Take-Two Interactive Software, Autozone

Toll Brothers: The upscale homebuilder will report earnings, and Cramer is watching to see if the company is still buying back stock.

"I don't think people realize how powerful their urban business is," he said. "My wife and I kicked the tires on some of their apartments in Brooklyn's marvelous waterfront development, Pier House, and they have steadily risen in value."

Take-Two: The video game maker behind the Grand Theft Auto franchise will also report earnings, and it's no secret that Cramer loves how the rise of gaming correlates with the emerging stay-at-home economy.

Take-Two's stock has rallied 38 percent this year, and Cramer expects the numbers to reflect its recent success.

Autozone: "One of the great bear stories of this era is the weakness in auto parts," the "Mad Money" host said. "Autozone's been in the blast zone and it reports on Tuesday. Maybe it can turn around the group. Lordy, they certainly need all the help they can get. We've got to see what's happened with Autozone's accelerated buyback."

Wednesday: Retail earnings

Lowe's and Tiffany & Co. will report earnings before Wednesday's bell, and PVH will report after the close. In the game of "is retail strong or weak," Cramer expects all three to be strong.

He expects good things for Lowe's because Home Depot's earnings were so strong, positive trends for Tiffany because the dollar will no longer be a drag on its numbers and sales have been up, and a great story for PVH, which is dominating the hottest apparel market in the world: Europe.

Thursday: Best Buy, Burlington Stores, Costco Wholesale Corp.

Best Buy: The electronics retailer will report earnings, and Cramer wonders if the only thing powering its sales is the new Nintendo Switch device.

Still, he expects a positive outlook and improving gross margins, boosted by the company's ability to beat back competition from the all-consuming Amazon.

Burlington: Along with fellow bargain retailer Ollie's Bargain Outlet, the discount chain has been doing well in a faltering retail environment.

"I doubt it'll disappoint and if it's down ahead of the quarter — in other words, let's say it goes down Wednesday because the New York Times and the Washington Post said there were 438,000 leaks to the Russians — well, then you've got a chance, maybe, to buy some Burlington," Cramer said. "I think it could be a decent trade."

Costco: Cramer dubs this chain non-Amazon-able due to its card membership fees paired with a discounted offering of bulk items. While the market may be bearish on its stock, Cramer likes Costco's story, and is looking forward to its earnings report.

"Costco just gave you a seven dollar special dividend, something I don't think they would do if business weren't good," he said.

Friday: Big Lots

Big Lots: Few retailers offer better bargains than Big Lots, and Cramer is watching its Friday earnings report closely.

"I just wish I liked it a little bit more because I know the analysts do, and if they report a good number the stock's going to jump," Cramer said. "It's always mentioned as a takeover name."

All in all, with earnings season tapering out, Cramer said the market will have to turn to Fed speakers for hints on consumer sentiment, the well-being of the economy, and whether the Fed will stick to its plans to hike interest rates twice in 2017.

"The banks can't help you with that. Only the Fed heads can," he said. "So we'll have to color our thinking with how the Trump economic agenda is doing and see if it's referenced as something that's gone MIA because of political turmoil, which could be a signal that the Fed's not tightening in June, something that could, alas, trump anything positive in a very negative way."

Watch the full segment here:

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com